A Guide to Gym Debt CollectionGym Debt Collection: How to Recover Unpaid Membership Fees the Right WayA Guide to Gym Debt Collection

Gyms rely on membership fees. They provide a predictable, recurring revenue stream that is key to the operations of most fitness facilities.

Unfortunately, unpaid membership fees cost the fitness industry billions every year.

Most gyms lose 5-9% of expected revenue to payment failures and delinquent accounts. This means that a gym doing $500,000 annually is watching $25,000-$45,000 just… walk out the door.

The mistake most gym owners make with gym debt collection is going too aggressive, too fast. Members talk and reviews spread quickly. Plus, acquiring a new member costs way more than you’ll recover from chasing down a single delinquent account, so it’s important to have an ethical recovery process in place.

With the right strategies, you can maintain positive relationships with your members while maximizing the amount of overdue membership fees you’re able to recover.

Debt collection for gym management has gotten smarter in recent years, and the right systems help you recover more without torching your reputation—while still leaving the door open for members to return when their finances improve.

Let’s explore best practices for gym membership debt collection and highlight how to maximize your revenue recovery.

TL;DR:

Good gym debt collection balances revenue recovery with member relationships. Focus on prevention first, then use compliant, empathetic practices when accounts go delinquent.

Table of Contents

- Why Gym Debt Collection Looks Different in 2026

- Common Reasons Members Fall Behind

- When to Send Accounts to Collections

- Ethical Best Practices for Gym Debt Collection

- FDCPA Compliance: What You Need to Know

- Manual vs. Automated Recovery

- Prevention Strategies That Actually Work

- The Financial Impact of Poor Collection Practices

- FAQ: Gym Debt Collection

Why Gym Debt Collection Looks Different in 2026

The people joining gyms today have updated expectations.

For instance, demographic data shows 60% of new gym joins are Gen Z and Millennials. These generations grew up with apps and expect digital-first experiences (not to mention they will absolutely post about bad experiences).

Old-school debt collection gym management backfires more often than it works. Angry phone calls, threatening letters, and immediate credit reporting may have made sense when your members couldn’t easily share their experiences with hundreds or thousands of people online.

These days, you’re at risk of damaging your brand and you don’t actually collect more money.

Most gyms have moved to automated retry systems that catch failed payments before anyone even notices.

The compliance landscape has gotten stricter, too. FDCPA and FTC guidelines now dictate exactly what you can say and when you can say it.

But the bigger shift is attitudinal.

Gym owners are realizing that how you treat someone during a rough patch matters. Those members come back when things improve, and they tell people you were decent about it.

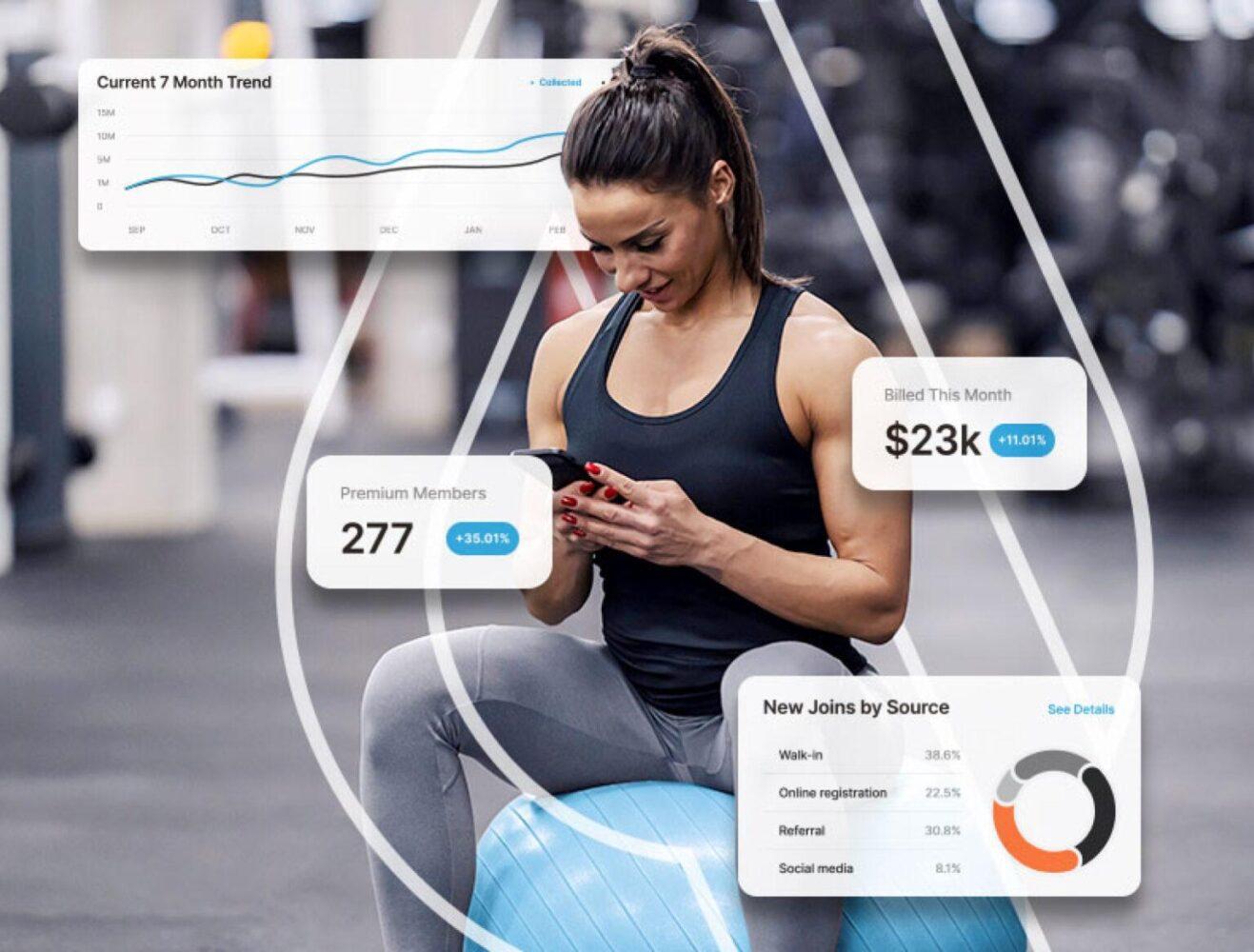

Analytics platforms help identify at-risk accounts before they become delinquent, which gives you a chance to reach out before a missed payment turns into a collections situation.

👀 Check out our on-demand webinar: The New State of Billing and Payments in the Fitness Industry

Common Reasons Members Fall Behind

Understanding why payments fail helps you prevent most of them.

Outdated payment information is the biggest one by far. Most of the time, people aren’t dodging you. They just forgot their card expired or switched banks!

- Automated card updater technology resolves many of these automatically without anyone on your staff getting involved.

Financial hardship is the other big category. People lose jobs, get hit with medical bills, or work seasonal jobs where income drops for months at a time.

- Research shows 38% of Millennials and 41% of Gen Z have carried fitness-related debt at some point. Many of these people genuinely want to keep their membership, but they just can’t pay right now.

Then there’s confusion. A member thinks they cancelled six months ago, or they had no idea there was an annual fee coming. When a charge feels like a surprise, people call their bank to dispute it instead of calling you to pay. Better communication at signup helps you avoid this scenario.

Billing questions that go unanswered turn into bigger problems, too. Someone has a question about a charge, can’t get through to anyone, and eventually just cancels.

A branded member app keeps members informed and gives them easy access to support so those small issues don’t spiral.

📝 Read More: The Demographic Data Reshaping How We Think About Fitness

When to Send Accounts to Collections

The fitness industry rule of thumb is to consider outside collections after 90 days of non-payment, assuming you’ve been reaching out consistently. This timeline for debt collection for gym management gives members a fair chance to sort things out while protecting your revenue.

Before escalating any account, make sure you’ve:

- Sent multiple payment reminders via email, SMS, and app notifications

- Attempted phone contact at least twice

- Offered payment plans or hardship accommodations

- Documented all communication attempts

- Sent a formal final notice explaining consequences

State laws vary quite a bit on debt collection gym management. California and New York have particularly strict consumer protection rules, so check what’s required in your area before taking action.

Don’t forget to spell out this entire process in your membership agreement. You get fewer disputes when members know what to expect from the start.

→ When the member remains unresponsive after proper notice, it becomes justifiable to engage a professional collections agency. Vet agencies thoroughly and pick one that specializes in debt collection for gym memberships.

Reporting to credit bureaus

Credit bureau reporting is an option when you’ve exhausted everything else and an account is seriously past due.

The Fair Credit Reporting Act allows you to report members over 90 days late, but you need to follow a specific process: send a letter warning that you’ll report if they don’t pay within 30 days, list the specific late payments with dates and amounts, wait the full 30 days, then follow through.

A credit hit gets attention, which is often what finally prompts payment. But if you use this for every account that’s a few weeks late, word gets around that you’re aggressive. Save this option for the accounts where you’ve genuinely tried everything else.

Many gyms work with collection agencies who handle the credit reporting and take on the compliance liability, which keeps you out of the weeds.

Ethical Best Practices for Gym Debt Collection

People join gyms partly for the community. In fact, ABC Fitness’s Wellness Watch report found 73% of members say that’s what keeps them motivated.

Your gym debt collection practices either keep that door open or slam it shut. The gyms that get this right treat debt collection gym management as part of the overall member experience.

While you have leverage to collect unpaid debt, maintaining an ethical, professional approach is key. You should always avoid aggressive tactics and instead work with members to reach reasonable solutions.

When you reach out to someone behind on payments, don’t lead with demands. Instead, ask what’s going on:

- “We noticed your payment didn’t go through—is everything okay?” opens a conversation instead of a confrontation. A surprising number of these situations resolve quickly once someone just talks to the member, and treats them with empathy.

Keep these conversations private and discreet. If you discuss someone’s account where other members can overhear, you’ve guaranteed they’ll never come back (and they’ll make sure everyone they know hears about it).

Other strategies like payment plans, temporary freezes, and reduced-rate memberships can recover partial revenue while keeping someone connected to your gym. For example, Click2Save retention tools automate these offers during cancellation.

On the documentation side, keep records of every conversation. You’ll want that paper trail if anything ever becomes a legal dispute.

FDCPA Compliance: What You Need to Know

As a gym owner, it’s important to understand the current rules and regulations surrounding debt collection for gym management.

The Fair Debt Collection Practices Act (FDCPA) sets the ground rules. Parts of it apply even when you’re handling collections in-house, and all of it applies if you use outside agencies.

⚠️ FDCPA Quick Reference:

- Contact only between 8am-9pm (the debtor’s time zone)

- Send written notice within 5 days of first contact

- Stop contact if the debtor requests it in writing

- Never discuss debts with employers, family, or friends

- Collectors cannot call repeatedly in a harassing manner

- False threats or misrepresentation of identity is unlawful

- Abusive, profane, or threatening language is strictly prohibited

Members can dispute whether they owe the debt, so you need a process for this scenario as well.

Check out the FTC’s FDCPA resource page for the full legal text. And if you’re using third-party agencies for gym membership debt collection, make sure they’re following these rules, too.

While collectors have latitude to contact and encourage payment, they can’t use unethical or aggressive tactics. Following FDCPA guidelines protects your gym from liability and keeps your brand reputation intact, even if you’re not legally on the hook.

Manual vs. Automated Recovery

Chasing down payments manually is fun for no one.

Your staff may forget to follow up, put off the awkward conversations, or they tell members different things because there’s no standard process. The whole thing eats up time that could go toward actually helping members. Plus you end up capturing less revenue anyway because the follow-up is so inconsistent.

Automated retry systems are consistent in a way that humans just aren’t. Retries happen at the optimal time for each card type, expired cards get updated automatically when possible, and reminders go out on schedule without anyone having to remember. Everything gets documented, and your staff can spend their time on things that actually need a human touch.

ABC Ignite’s Revenue Cycle Management is built around this idea. You configure your reminder sequences and retry logic, and then the system just runs.

📝 Read More: Fit for the Future: How AI is a Force for Good for Fitness Club Owners

Prevention Strategies That Actually Work

When it comes to debt collection for gym management, it’s cheaper to prevent a delinquent account than to chase one down. Plus, members feel differently about a gym that’s proactive versus one that comes after them for money.

The gyms with the best collection rates tend to share a few prevention strategies in common.

First, their membership agreements properly explain how billing works and have clear escalation policies in place. Billing dates, cancellation rules, annual fees, and what happens if a payment fails are all in writing from day one, so members can’t claim they didn’t know.

Getting a backup payment method at signup is another one. If the primary card fails, the system tries the backup before the account even gets flagged. Most modern billing platforms support this, and members generally don’t mind if you explain why at signup.

Sending expiration alerts 30-60 days before cards expire gives a quick heads-up that prevents most payment failures. It’s important to make freezing or cancelling easy, because people will just stop paying if it’s hard to pause a membership. Digital self-service through a member app handles both of these.

Members who actually use the gym almost never let payments lapse. Engagement tools help you spot when someone stops showing up so you can reach out before they become a collections problem. Finally, letting members pick a billing date that matches their payday reduces failed payments more than most people expect.

📝 Check Out: Transform Your Member Experience: Why Your Fitness Business Needs a Club-Branded App

The Financial Impact of Poor Collection Practices

Gym membership debt collection mistakes cost more than just the uncollected dues.

Every hour your staff spends chasing a $50 membership is an hour not spent helping members or closing sales. One angry post about how you handled a late payment can cost you more in lost referrals than that debt was ever worth. (Unfortunately, an upset member isn’t sending anyone your way.)

Plus, members who feel harassed over a payment issue rarely come back, even years later when their situation has improved.

Your ability to plan financially suffers, too, when you don’t know how much you’re actually collecting. Equipment purchases, staffing, expansion—all of it gets harder when you’re guessing.

Retention is way cheaper than acquisition, so losing someone you didn’t have to lose is expensive.

Steady outreach and consistent follow-up recovers far more than occasional phone calls while keeping your positive brand image intact.

📝 Read More: DXFactor: ABC Ignite’s Secret to Maximizing Gym Member ROI

FAQ: Gym Debt Collection

What’s the most effective way to prevent gym membership debt collection issues?

Get your billing system to prompt members to update credit cards before they expire. This alone prevents a huge chunk of failures. Platforms like ABC Ignite handle this without your staff having to lift a finger.

What steps should gyms take before sending accounts to collections?

Reach out through multiple channels—email, text, app notification, phone—and give members a chance to respond. If someone’s struggling financially, offer a payment plan or let them freeze their membership to ease the pressure.

Most gyms allow 90 days of consistent, good-faith outreach before involving an outside agency.

Can gyms report unpaid memberships to credit bureaus?

You can, but there’s a process, and it’s not something you can just do on a whim. This is why most gyms go through professional third-party agencies who already know the rules and take on the legal exposure.

How does automated billing reduce delinquent accounts?

The billing system retries at the right moment, prompts users to update credit cards, and sends timely reminders. It’s really just about consistency. Humans aren’t great at following up the same way every time, and missed follow-ups turn into lost revenue.

Master Gym Debt Collection Without Sacrificing Member Relationships

Good debt collection for gym management is about finding the balance between recovering revenue and keeping members.

Gyms that handle gym debt collection well tend to have the following:

- Billing systems that catch problems ahead of time

- Clear policies from day one

- Staff who treat people well when issues do arise

- A defined process for escalating should it become necessary

Recovering missed revenue doesn’t need to be a drain on your gym’s time and focus.

ABC Ignite’s Revenue Cycle Management helps fitness businesses recover more revenue while maintaining member relationships. Intelligent billing, automated follow-up, and integrated gym debt collection support let you focus on what really matters: helping members reach their health and wellness goals.

Ready to improve your revenue recovery? If chasing down late payments has become an endless distraction, let ABC Ignite show you how our automated gym membership debt collection tools can benefit your gym.