A Guide to Gym Debt Collection

Gyms rely on membership fees. They provide a predictable, recurring revenue stream that is key to the operations of most fitness facilities.

So naturally, when members fall behind on payments, it can quickly add up to a substantial amount of lost revenue—not to mention it can also create an administrative bottleneck for your staff.

In today’s economy, it’s more important than ever for gyms to have effective debt collection practices in place. With the right strategies, you can maintain positive relationships with your members while maximizing the amount of overdue membership fees you’re able to recover.

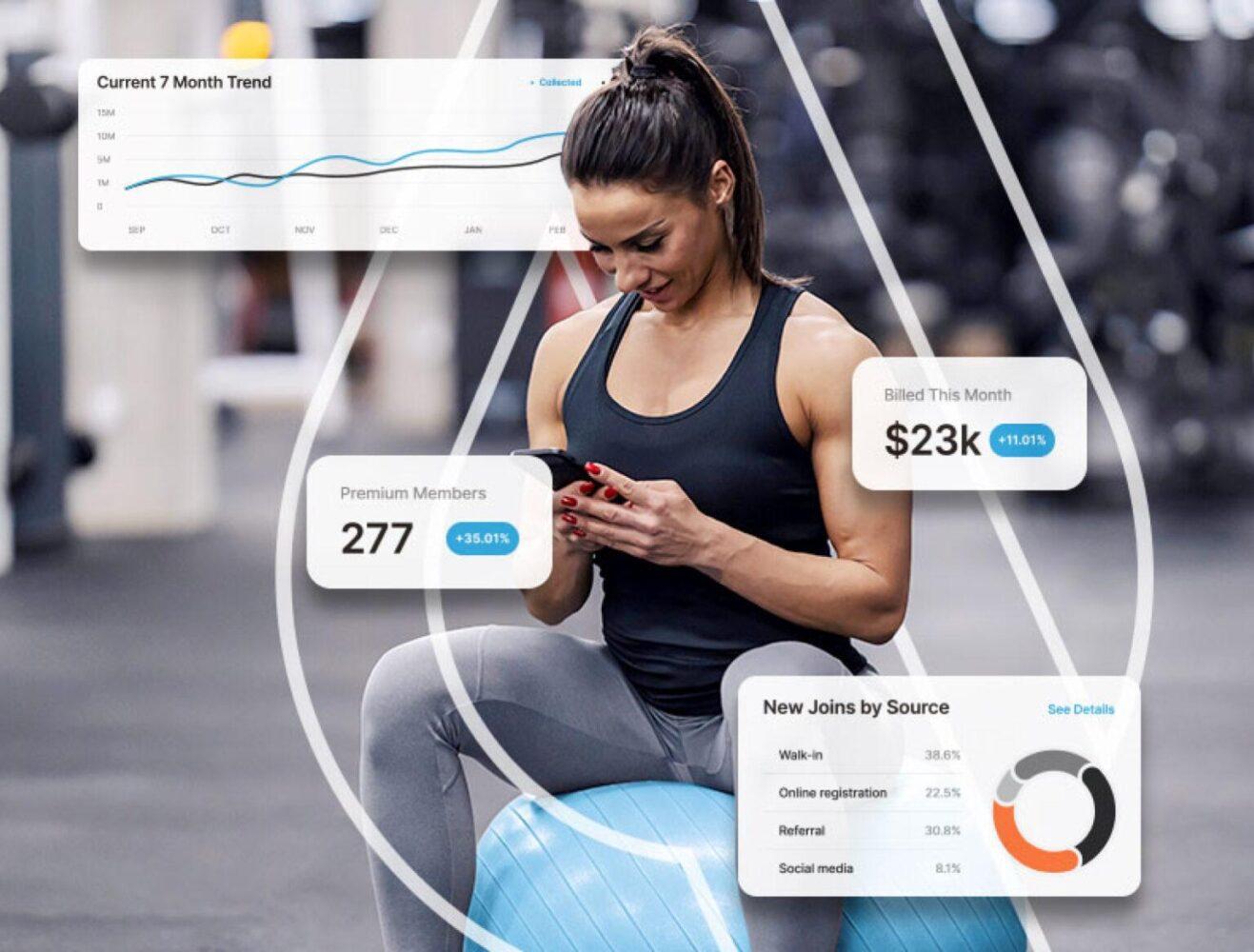

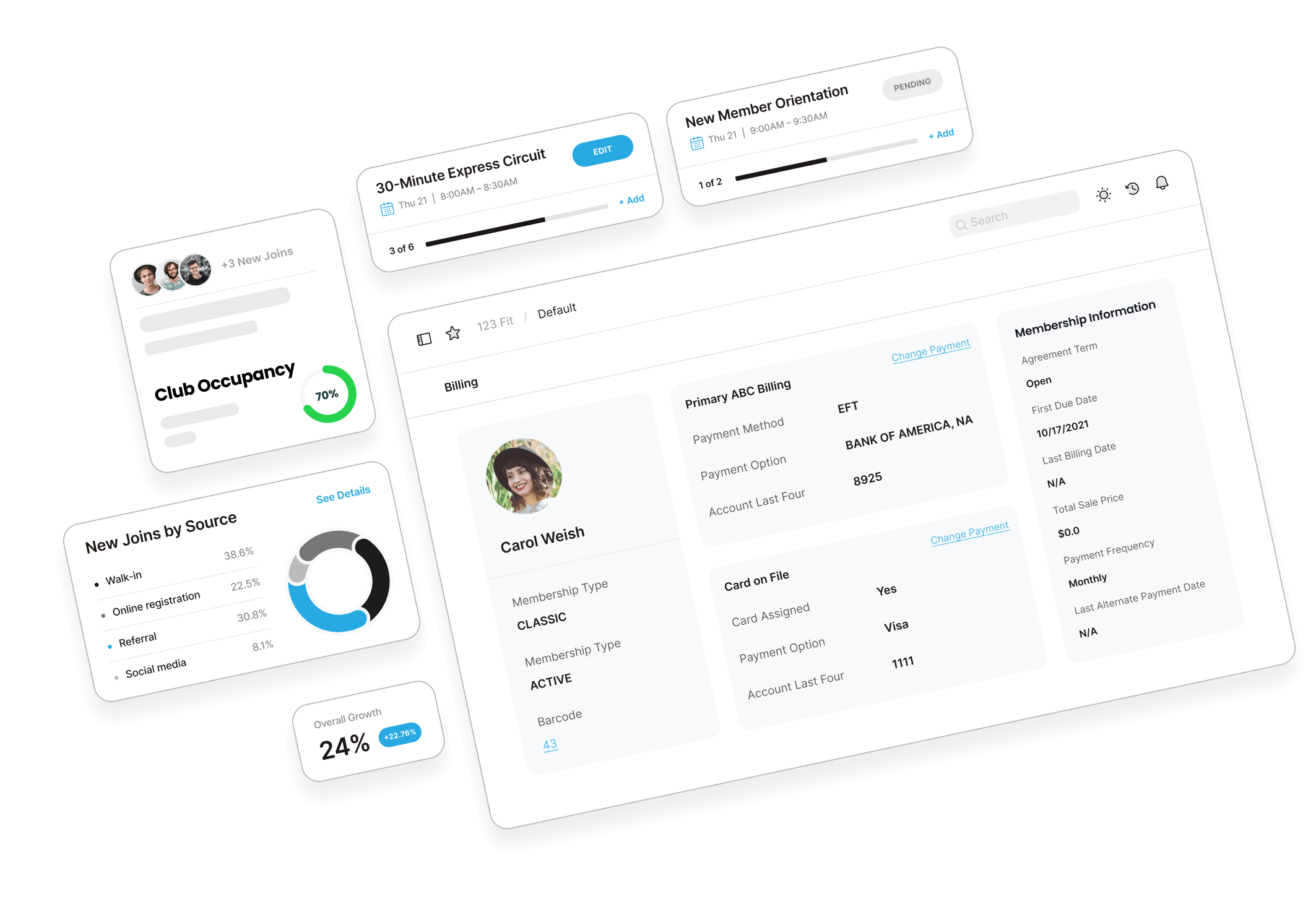

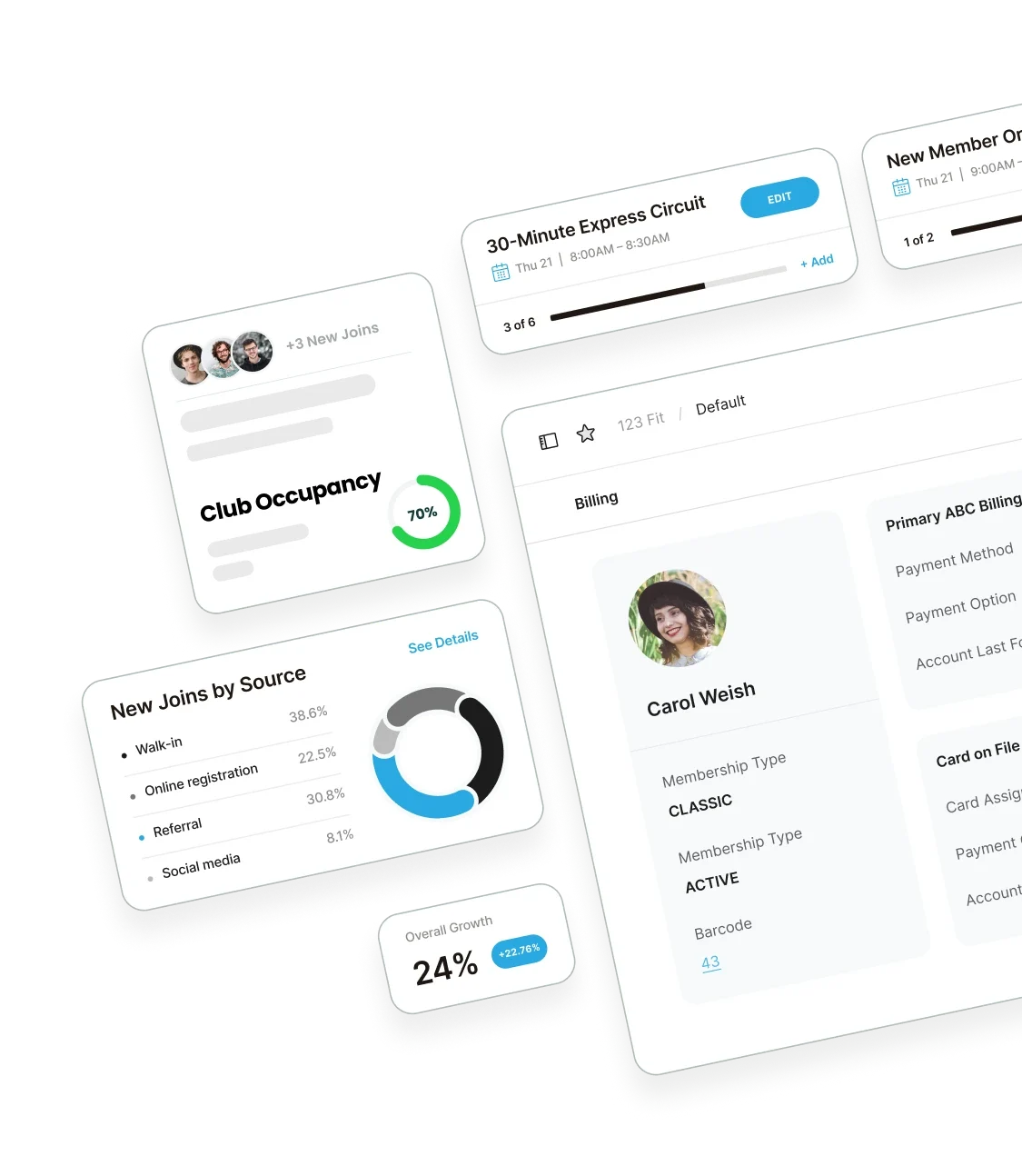

Full service billing solutions are revolutionizing how modern gyms collect and optimize revenue. By outsourcing billing and collections to the experts at ABC Ignite, gym owners see increased revenue, reduced administrative burden, and happier members.

Let’s explore best practices for gym membership debt collection and highlight how to maximize your revenue recovery.

How and When to Send Past Due Accounts to Collections

When is it appropriate to send a member’s account to collections?

Here are some best practices:

- Wait until they are at least 90 days late on payments before considering collections. Allow reasonable time for reminder notices to prompt payment.

- Review your membership agreement and state debt collection laws. Some states require notifying members 30-90 days in advance before referring to collections.

- Document all attempts you’ve made to collect the debt through payment reminders, emails, calls, letters, and payment plans. Showing you’ve tried demonstrates that the account is severely late.

- Send a final letter stating you plan to place their account with a collection agency if the past due amount is not paid within 30 days. List the specific late payments you plan to pursue.

When the member remains unresponsive after proper notice, it becomes justifiable to engage a professional collections agency. Vet agencies thoroughly and pick one that specializes in debt collection for gym memberships.

How to Ethically Handle Gym Membership Debt Collection

While you have leverage to collect unpaid debt, maintaining an ethical, professional approach is key. You should always avoid aggressive tactics and instead work with members to reach reasonable solutions.

For example:

- Train staff to communicate with empathy when following up on late payments.

- Offer flexible repayment options demonstrating you aim to continue the membership.

- Handle collection discussions discreetly away from other members.

Regardless of the situation, don’t forget to document all attempts to collect debt thoroughly; records showing your efforts to work with the member can defend against any unlawful claims.

Following the Fair Debt Collection Practices Act

As a gym owner, it’s important to understand the current rules and regulations surrounding debt collection.

The Fair Debt Collection Practices Act (FDCPA) governs how third-party debt collectors can attempt to recover gym membership debt.

Here are some key guidelines from the FDCPA that collection agencies must follow:

- Communication must be between 8am-9pm in the debtor’s time zone. Calling outside these hours risks violations.

- Collectors cannot call repeatedly in a harassing manner. Spacing out calls avoids claims of harassment.

- Abusive, profane, or threatening language is strictly prohibited. Collectors must remain professional.

- False threats or misrepresentation of identity is unlawful. Collectors must be transparent.

- Debtors have a right to request in writing to stop contact. Collectors must honor do-not-contact notices.

While collectors have latitude to contact and encourage payment, they can’t use unethical or aggressive tactics. Following FDCPA guidelines protects your gym from liability.

Reporting Late Members to Credit Bureaus

For accounts that remain severely past due after collection efforts, reporting the member to credit bureaus can motivate payment. Under the Fair Credit Reporting Act, you have the right to report members who are over 90 days late on gym membership payments.

Before reporting a member, send a letter stating your intent to report their delinquency if payment in full is not received within 30 days. List their specific late payments that you plan to report and if payment is still not made, follow through with reporting to hold them accountable.

A negative mark on a credit report creates consequences for the member, often prompting them to finally pay the amount owed. We recommend using credit bureau reporting judiciously for severe cases only.

Discover Automated Debt Collection for Gym Memberships

Manual gym membership debt collection ties up staff and risks missed follow-ups.

Recovering missed revenue doesn’t need to be a drain on your gym’s time and focus. At ABC Ignite, we understand the nuances of fitness debt recovery. Our automated, ethical collections process is tailored for the unique needs of gyms and fitness centers.

The ABC Ignite team can securely handle the entire process on your behalf while simultaneously offering far greater efficiency and compliance.

Our gym management software includes:

- Customizable late payment reminders and follow-ups

- Detailed accounts receivable tracking

- Extensive reports on past due members

- Integration with professional, ethical collections partners

- Seamless credit bureau reporting for severe delinquencies

If chasing down late payments has become an endless distraction, let ABC Ignite show you how our automated gym membership debt collection tools can benefit your gym.