The Data That Should Keep Every Fitness Operator Up at Night (And What to Do About It in 2026)

By Lee Robinson, VP of Sales, ABC Fitness

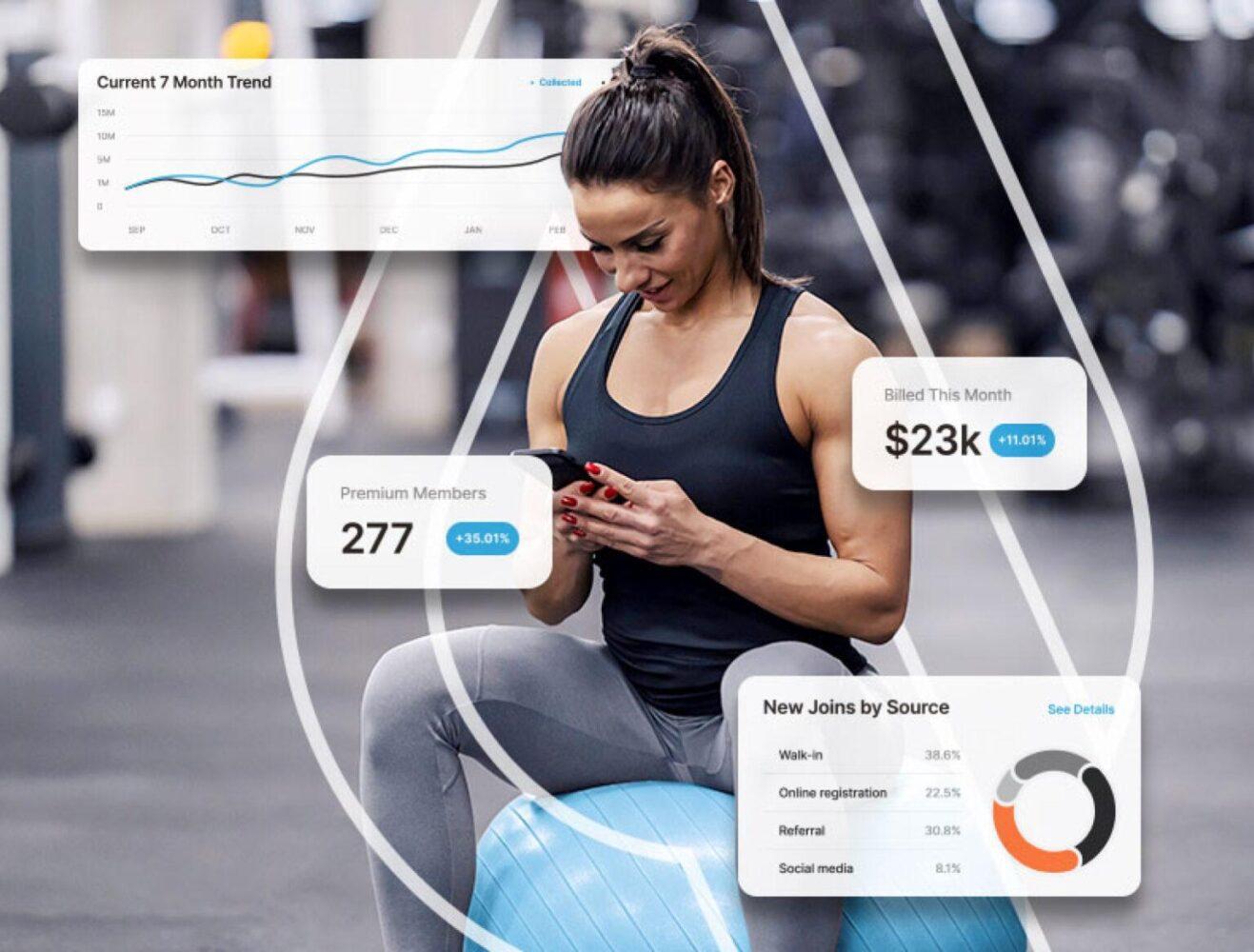

Every December, I do the same thing: lock myself in my home office with a cup of coffee (okay, three cups), review the year’s fitness industry data, and look for the story underneath the numbers. The end-of-the-year ABC Fitness Wellness Watch Report just dropped, analyzing 600 million check-ins across 30,000 facilities and 40 million members. And what I’m seeing isn’t just interesting—it’s a blueprint for who wins and who gets left behind in 2026.

Here’s the truth: acquisition is softening, but engagement is climbing. That contradiction is the entire story of 2025, and if you don’t understand what’s driving it, you’re going to make the wrong bets next year.

Let me walk you through what the data actually says—and what it means for operators trying to hit growth targets in an increasingly complex market.

The Gen Z Reality: They’re Not the Future, They’re the Present

47% of all new gym joins in 2025 came from Gen Z.

Read that again. Nearly half. This isn’t “the next generation we need to prepare for.” They’re walking through your doors right now, and most operators are still running playbooks built for their parents.

Here’s what blows my mind: despite being hit harder by inflation than any other cohort, 65% of Gen Z are increasing their fitness spend. They’re not price-sensitive in the way we think. They’re value-sensitive. And community is the value they’re buying.

47% of Gen Z say community is the reason they stick with fitness. Not equipment. Not price. Not even results—at least not initially. Belonging comes first.

I see this in my own daughter’s generation. Fitness isn’t about transformation montages or “no pain, no gain” anymore. It’s about showing up with people who get you, posting content that reflects your identity, and feeling like you’re part of something bigger than a workout.

If your gym still feels like a transaction factory—swipe in, lift, leave—you’re losing this generation before they hit their third visit.

The Retention Paradox: More Check-Ins, More Cancellations

Here’s where it gets interesting. Check-ins are up 11% since 2021. Engagement is climbing. People who are in are going more often.

But cancellations are also up 8% year-over-year.

How do you reconcile those two trends?

Simple: Your membership base is bifurcating.

You’ve got one segment—maybe 30-40% of your members—visiting 8-12+ times a month, upgrading to premium tiers, buying PT sessions, using recovery amenities, and probably recruiting their friends. Their lifetime value is skyrocketing.

Then you’ve got another segment—35-45%—visiting 0-3 times a month, ghosting after the first few weeks, and churning the moment click-to-cancel makes it frictionless.

The middle is disappearing.

Click-to-cancel didn’t create this problem. It revealed it. The court ruling that struck down the FTC’s nationwide mandate bought operators some breathing room, but here’s the thing: the market is moving that direction anyway. Several states are already there. Member expectations have shifted. Fighting frictionless cancellation is like fighting the tide.

The real question is: Are you building a business that depends on trapped members, or engaged ones?

Because the data screams one truth: engagement in the first 30 days determines everything downstream.

Studios Got the Memo: Depth Beats Breadth

While big-box gyms saw new joins drop 1%, studios dropped 3%. But here’s the twist: studio cancellations fell 6%, and check-ins rose 1%.

Translation: Studios are winning on retention even as top-of-funnel softens.

Why? Because studios figured out the belonging equation first.

Studio members pay an average of $123.23/month—nearly 5x what many high-value-low-price (HVLP) gyms charge—and they stay. Not because they’re trapped, but because they’ve built relationships. With instructors. With other members. With the experience itself.

88% of studio operators say instructors are “absolutely critical” to their brand. Of course they are. Because instructors create the emotional connection that turns a transaction into a relationship.

Big-box gyms are catching on. Crunch 3.0 is adding hot studios, boutique-style platforms, and curated class experiences. Vasa’s Studio LFT had over 1,500 waitlisted sessions in its pilot. Planet Fitness is testing red light therapy and recovery zones as Black Card perks.

The playbook is clear: bring the boutique experience to the value price point, and wrap it in community.

Pilates: The Quiet Powerhouse

I’ve been watching Pilates for two years now, and every quarter the story gets more compelling.

New joins dropped 8.8% in 2025. But check-ins climbed 4.3%, and cancellations fell 6.1%.

This is what a mature, high-engagement category looks like. Pilates isn’t chasing growth through aggressive acquisition. It’s compounding retention and frequency among people who are already in.

Club Pilates has 1,300+ locations. Pilates Addiction sold 100+ territories within months of launch. Strong Pilates is opening studios with 300-500 members on day one.

The global Pilates and yoga market is projected to hit $521 billion by 2035—a 4x increase from 2025.

Why? Because Pilates sits at the intersection of three massive trends:

- Strength training dominance (up 29% YoY per Garmin data)

- Low-impact, longevity-focused movement (the anti-“beast mode” backlash)

- Women’s health and functional fitness

It’s not a fad. It’s a fundamental shift in how people—especially women—want to train.

The Payment Infrastructure Problem No One’s Talking About

Here’s a data point that should terrify every operator with thin margins:

Neobanks account for 4% of ACH payment volume but 26.3% of all returns.

Let me put that in dollars. If you’re a 5,000-member club doing $125K in monthly revenue, and 17% of your new joins use neobanks (which is the current average), you’re looking at potential payment failures of $72K-$144K annually from this segment alone.

Why? Because neobanks—Chime, Cash App, Varo—are designed for people living paycheck to paycheck. They allow users to freeze accounts, have no minimum balances, and can’t be overdrawn. All good consumer protections. All nightmares for recurring billing.

And guess who uses neobanks? Gen Z. The same cohort driving your growth.

Here’s the operational fix, and it’s non-negotiable: If a new member wants to use a neobank as their primary payment method, require a traditional bank account or credit card as backup.

Second: Upgrade your payment infrastructure. Digital wallets (Apple Pay, Google Pay) now represent 18% of preferred payment methods and growing. Buy-now-pay-later (BNPL) is surging among Millennials and Gen Z. FSA/HSA payments are a massive untapped revenue stream for 2026, especially with the PHIT Act gaining traction.

Failed payments drive up to 1 in 3 cancellations. This isn’t a finance problem. It’s a retention problem.

AI: High Usage, Low Trust (And What That Means for Operators)

64% of Gen Z and 59% of Millennials have used an AI-powered fitness or wellness app.

But here’s the trust gap: Only 33% of Gen Z, 43% of Millennials, and 17% of Boomers actually trust AI apps for their wellness.

People are using AI. They’re just not trusting it yet.

What does that mean for operators?

Position AI as a co-pilot, not a replacement.

Use AI for:

- Churn prediction (flag at-risk members before they ghost)

- Personalized engagement (smart alerts, tailored offers, milestone recognition)

- Payment intelligence (predict which payment methods will fail, proactive dunning)

- Programming efficiency (AI-assisted workout plans that trainers customize)

But keep humans in the loop. Members don’t want a robot telling them how to train. They want a coach who uses smart tools to serve them better.

Life Time’s L.AI.C assistant is a perfect example—free, integrated into the app, offering proactive guidance without replacing the human connection.

ABC Fitness’s CSO Mo Iqbal nailed it: “The future of fitness isn’t just more data; it’s better decisions, made faster, in service of every member.”

That’s the play. AI for intelligence. Humans for empathy.

Community Is the New Retention Moat

73% of consumers say being part of a fitness community helps them stay motivated.

1 in 3 members engage with fitness communities daily.

Let that sink in. Community is no longer a “nice-to-have.” It’s infrastructure.

The operators who win in 2026 are the ones pairing strong in-person culture with digital groups, challenges, leaderboards, and referral programs that keep members connected every single day—not just when they’re in the building.

Look at the run club explosion. Strava reported run clubs tripled globally in 2025 with Brazil seeing an 800% increase. ClassPass data shows team sports and community-led formats are surging.

Why? Because people are lonely. Gallup data shows 1 in 4 adults globally report loneliness. Fitness is one of the few places where adults can build authentic, recurring social connection without it feeling forced.

Your gym isn’t competing with other gyms anymore. You’re competing with isolation, digital distraction, and the erosion of third spaces.

Build belonging, and retention takes care of itself.

The Single Metric That Matters Most in 2026

If I could only track one number next year, it would be this:

Visits per member in the first 30 days.

Not total member count. Not monthly new joins. Not even cancellation rate.

Why? Because everything downstream is determined by early activation.

- Members who hit 5 visits in the first month have a 90%+ retention rate (per Mariana Tek data)

- First-time visitor return rate separates top performers (76%) from average operators (57%)

- Life Time’s 12.7 visits per member per month correlates directly with record retention and pricing power

If you’re not tracking 30-day engagement by cohort, you’re flying blind.

Here’s the intervention playbook:

Day 7: <2 visits → Automated email/text with class suggestions Day 14: <3 visits → Staff call to schedule goal-setting session

Day 21: <4 visits → Manager personal outreach + incentive offer

Day 30: <5 visits → Last-chance engagement attempt

Stop measuring joins. Start measuring activation.

What This All Means: The 2026 Playbook

ABC Fitness CEO Bill Davis said it perfectly: “The brands that will win 2026 are the ones that pair easy, flexible ways to join and pay with experiences that make people feel like they belong the moment they walk through the door.”

That’s not inspirational fluff. That’s operational strategy.

Here’s what it looks like in practice:

Things to STOP Doing in your Gym in 2026:

- Treating Gen Z like Millennials – They don’t want 60-minute classes, long-term contracts, or influencer marketing. They want flexibility, gamification, social experiences, and authenticity.

- Ignoring payment infrastructure – Neobank failures are bleeding revenue. Upgrade to modern payment rails, require backup methods, and enable digital wallets.

- Measuring vanity metrics – Total member count is meaningless if engagement is low. Track activation and cohort retention instead.

- Building for the middle market – The middle is dead. You’re either value-with-premium-features (Crunch, Vasa, Planet Fitness) or holistic-wellness-ecosystem (Life Time, Equinox). Pick a lane.

Things to START Doing in your Gym in 2026:

- Building for the 5th visit – Every new member needs a structured 14-day activation journey: goal-setting → program assignment → check-ins → milestone recognition.

- Integrating recovery as standard – 63% of consumers cite recovery as a key brand selection factor. It’s no longer premium—it’s foundational.

- Training staff on GLP-1 implications – Members need guidance on resistance training, protein intake, and body composition. Position yourself as the essential companion to medical weight loss.

- Leveraging AI for personalization – Use AI for programming, engagement, and retention predictions—but keep humans at the center of the coaching relationship.

- Treating community as infrastructure – Digital groups, challenges, referral programs, and events aren’t marketing tactics. They’re retention architecture.

Things to PAY ATTENTION TO in your Gym in 2026:

- The “Club of Studios” model – Multi-boutique concepts (LA Fitness Club Studio, Altea Active, Styles Studios) are democratizing boutique fitness at HVLP pricing.

- Corporate wellness partnerships – 89% of employees perform better when prioritizing health. Members from corporate partnerships often represent 21-50% of total membership base.

- Global expansion velocity – Asia-Pacific and Middle East are the fastest-growing regions. Master franchise deals are becoming the standard market entry strategy.

The Bottom Line for Fitness Industry Trends in 2026

2025 was the year the industry split into two paths: transactional fitness and relational fitness.

Transactional operators optimize for headcount, accept ghosting, and rely on billing inertia. They’re competing on price and hoping members forget they have a membership.

Relational operators optimize for activation, rescue disengaged members early, and build belonging into every interaction. They’re competing on experience and building communities that members can’t imagine leaving.

The data is clear: Relational operators are winning.

New joins may be softening, but engaged members are visiting more, staying longer, and spending more. Studios proved this model works at $120+/month. HVLP gyms are proving it works at $25/month.

The formula isn’t complicated:

- Make joining easy (digital wallets, BNPL, frictionless onboarding)

- Make belonging immediate (community, coaching, personalized engagement)

- Make activation systematic (track first 30 days, intervene early)

- Make payment infrastructure modern (backup methods, smart retry, digital wallets)

The operators who execute this playbook will grow 30%+ in 2026. The ones who don’t will fight for scraps in a shrinking middle market.

I know which side I’m on.

What about you?

These insights come from analyzing 40 million member interactions across 30,000+ fitness locations processing $12 billion in annual transactions. The patterns are measurable, the solutions are implementable, and the competitive advantage is available to operators ready to embrace data-driven operations.