The Reporting Wake-Up Call Every Gym Owner Needs

By Lee Robinson, VP of Sales, ABC Fitness

The fitness industry is in the middle of a massive shift. Over the past 12 months, I’ve talked with industry titans like Eddie Tock, Debra Strougo, Julie Cartwright, and Garrett Marshall. They all see the same thing coming: consolidation.

We’re not just talking about it anymore – we’re living it. This year alone, there have been 11 major acquisitions. EOS Fitness sold to TSG Group for $1.5 billion. 425 Fitness, Bay Clubs, Mac Fitness, and Benefit Systems all changed hands. The dominoes are falling fast.

But here’s what caught me off guard in these conversations: the gym owners getting premium valuations aren’t necessarily the ones with the flashiest facilities or the most locations. They’re the ones who can tell their story with numbers that actually make sense.

The Brutal Truth About Valuations

When someone wants to buy your gym, they don’t care about your passion or your community impact. They care about cash flow. And if you can’t show them clean, consistent financial data, they’ll dock your valuation by 10-15% before they even walk through your doors.

According to Deloitte, that’s the standard discount for messy books. For a $2 million business, you just lost $200,000 to $300,000 because your reporting is sloppy.

Think about that. You could lose a quarter-million dollars because you’re still using spreadsheets and hoping your bookkeeper remembers how to categorize things.

The Scaling Reality Check

Growing from 3 to 5 clubs feels manageable. Going from 5 to 15? That’s where most operators hit the wall. By the time you’re thinking about 30 or 100 locations, you need completely different systems.

But one thing stays constant at every level: you need bulletproof reporting. Not just for potential buyers, but for yourself. How else will you know which locations are actually making money?

What Buyers Actually Look For

(And Why Most Gyms Fail)

Recurring Revenue Clarity

Your membership dues are your crown jewel. Buyers want to know exactly how much hits your bank account each month, not how much you bill. There’s a big difference.

They’ll ask about your collection rates at 30, 60, and 90 days. If you’re below 90%, that’s a red flag. Industry benchmarks suggest anything under that threshold hurts your valuation significantly.

But here’s the kicker: if one person in your back office is manually calculating these numbers, you’ve got a single point of failure. What happens when they quit or make a mistake? Your collection rate might swing from 90% to 93% month to month, making your EBITDA projections unreliable.

Profit Center Breakdown

Buyers want to see your revenue streams clearly separated:

- Recurring memberships (the big one)

- Personal training and small groups

- Retail (supplements, apparel, food)

- Day passes and events

Each category needs to follow standard accounting practices. No Excel magic or “adjustments” that only your bookkeeper understands.

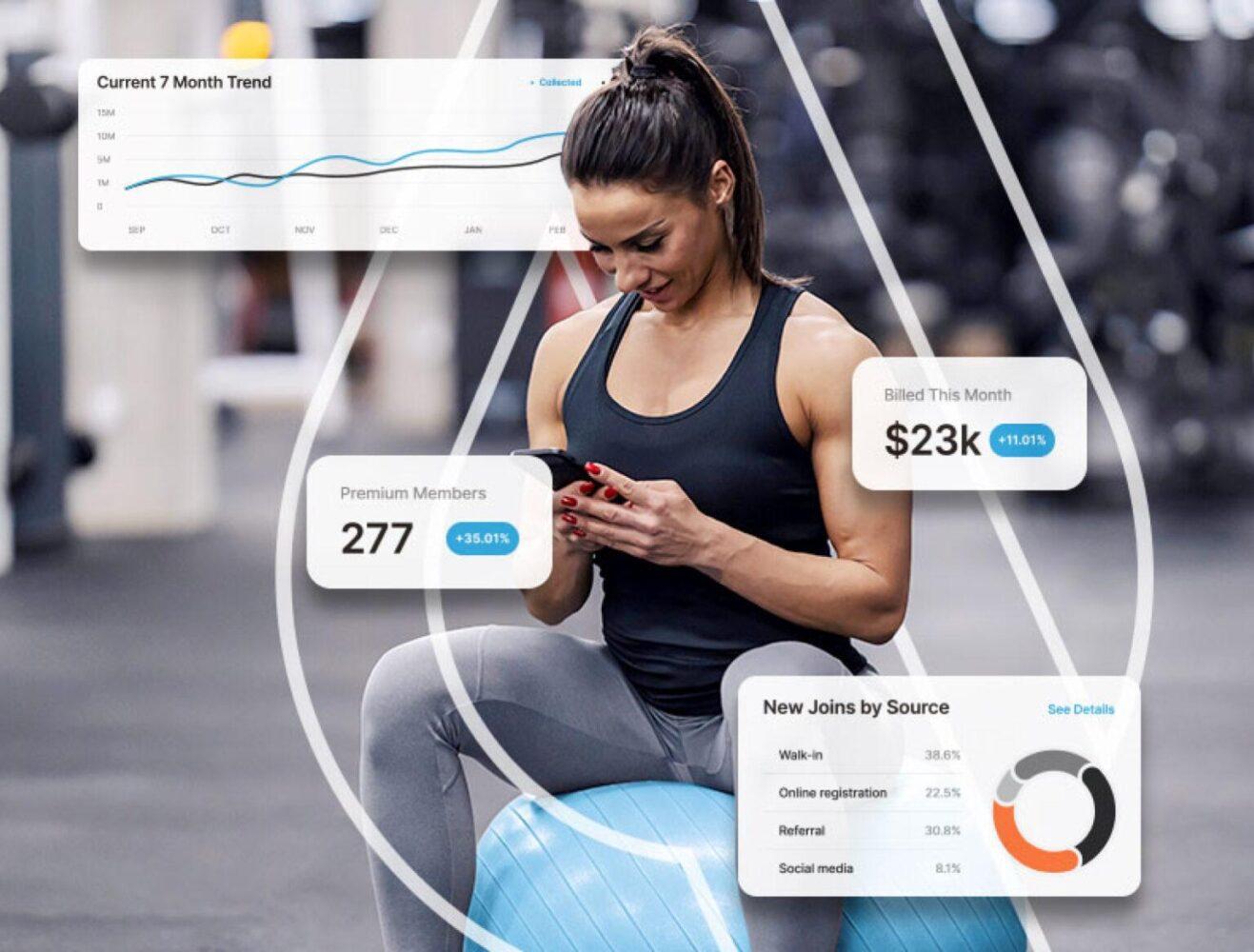

Lead Generation and Conversion

Where do your members come from? Social media? Community events? Walk-ins? What’s the conversion rate for each source?

This isn’t just useful for marketing. It tells buyers how predictable your growth is. Can you turn up the lead volume and reliably convert more members? That’s valuable.

Consistent Definitions

This might sound boring, but it’s crucial. When a member cancels, is that an “expired member,” “member in collections,” or something else? Your definition better be the same across all locations.

I’ve seen deals fall apart because the seller couldn’t explain why one location counted members differently than another.

The Hidden Costs of Bad Reporting

Poor reporting doesn’t just hurt when you’re trying to sell. It kills you every day you’re running the business.

You get weak unit-level margins because you can’t see which locations are actually profitable. You burn out because you’re constantly fighting fires instead of running toward opportunities. Your staff gets frustrated because they can’t get clear answers about performance.

And when potential buyers do their due diligence? They don’t just look at your books. They talk to your frontline staff. If your team can’t articulate how the business works, that’s another discount.

According to Harvard Business Review, businesses with strong reporting cultures outperform their peers by about 5% in profitability. That adds up fast.

The Path Forward

You need three things to fix this:

#1: One Source of Truth

Stop using multiple systems that don’t talk to each other. Get one platform where all your data lives. No more Excel spreadsheets. No more calling the back office to “validate” numbers.

#2: Automated Reporting

Your reports should show up when you need them, not when someone remembers to pull them. Daily sign-ups and cancellations. Weekly lead performance. Monthly P&L statements. Quarterly comparative analysis.

#3: Clear Access Controls

The right people need to see the right reports at the right time. Your front desk staff don’t need access to profit margins, but your managers do need to see conversion rates.

Why This Matters Right Now

The fitness industry consolidation isn’t slowing down. Bain & Company research shows that even a 3% improvement in collections can meaningfully increase your valuation. Small improvements in reporting accuracy compound over time.

Whether you’re planning to sell tomorrow or grow for the next decade, clean reporting is your foundation. The operators who get 3-5x multiples on their exits can tell their story clearly. They know exactly where their money comes from and where it goes.

The ones still struggling with spreadsheets? They’ll keep getting discounted valuations and wondering what went wrong.

The Bottom Line

Your reporting isn’t just an administrative task. It’s strategic leverage. It’s the difference between getting a premium valuation and leaving money on the table. It’s the difference between confident growth and constant uncertainty.

The fitness industry is consolidating around operators who have their act together. The question isn’t whether this trend will continue—it’s whether you’ll be ready when opportunity comes knocking.

Clean up your reporting now, before someone starts asking questions you can’t answer.

Ready to future-proof your fitness business?

See how ABC Fitness can help you turn data into growth.

👉 Request a Demo and start shaping the member experience of tomorrow, today.