Commerce 101: The New State of Billing and Payments in the Fitness Industry

Fitness business owners have one core focus in their business: revenue. If your payment structure or billing capabilities are not up to standard, members will leave for another fitness provider.

Apple and Google Pay, HFAs, FSAs, Neowallets, and a rise in employer-subsidized payments makes it vital that you are providing a modern, low-touch payments experience for your business.

Essentially, billing and payments aren’t just backend operations anymore; they’re a core part of your member experience, business growth, and profitability. At ABC Fitness, we have 40 years of experience in facilitating member payments for over 40 million members across 100+ countries.

With that experience, we’ve learned a few things about the past, present, and future of fitness payment systems. Below, we’ll provide you with 8 key learnings on fitness payments along with the best practices when it comes to fitness business billing.

Let’s dive into the top billing and payments trends shaping the fitness industry and why they matter to you.

- 8 Key Learning on Fitness Business Billing

- Billing and Payments Journey Best Practices

- How ABC Fitness Can Help You

8 Key Learnings on Fitness Business Billing

We discuss all the key elements of fitness business billing below, you can jump to each one of the links here:

- Digital Wallets Are on the Rise

- There is a growing demand for HSA/FSA Payments

- Real-Time Payments are Transforming Billing

- It’s Time to Step Back From Credit Cards

- Membership Models are Evolving

- Modern POS Systems Are Driving Upsells

- Intelligent Billing Will Maximize Your Collections

- E-Commerce and Online Marketplaces are Vital

#1: Digital Wallets Are on the Rise

Mobile wallets like Apple Pay and Google Pay are now among the preferred ways for members to pay for anything, and this is no different than with fitness businesses.

Why you should care:

- Speed: Digital payments are frictionless, leading to faster sign-ups and smoother checkouts.

- Convenience: Members expect it; offering digital wallets improves satisfaction.

- Security: Digital wallets are often more secure than physical cards, reducing fraud risk.

Audience insight: The demand for online and mobile payments is significantly on the rise, especially with Gen Z. Make sure you’re ready to cater for modern payment solutions.

Pro tip: Make sure your billing platform integrates with mobile wallets to remove friction at point-of-sale (POS). One singular friction point can easily lose you a sale.

#2: There is a Growing Demand for HSA/FSA Payments

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are increasingly being used for personal training, fitness memberships, and wellness activities. HSAs and FSAs are a type of personal savings account you can set up to pay certain health care costs. Although they differ in their use cases, their core focus is the same: tax-free spending on fitness memberships.

Why you should care:

- Unlock new revenue: Tap into pre-tax dollars members are already motivated to spend.

- Attract health-conscious clients: Position your club as part of their “wellness investment.”

- Focus on the business: Many of these accounts are employee-sponsored, allowing you to land and expand on corporate accounts.

Industry Insight: Baby Boomers are more focused on health and recovery based exercises than other generations, making them more likely to be using HSA or FSAs for their memberships.

Pro tip: Partner with providers like TrueMed (an ABC Fitness partner) to easily accept HSA/FSA payments.

#3: Real-Time Payments Are Transforming Billing

For most fitness businesses, their income is going to come from credit card and bank transfer payments. Generally, as a business, it suits you better to use bank transfers as their processing fees are much lower (from around 0.5% to over 3% for credit cards on average).

For bank transfers, ACH (or direct debit) is the old form of payment type, usually taking 1-3 business days and often leading to poorly timed transactions and delays in collections. The introduction of new real-time bank payment capabilities means you can move money faster, and at a lower cost. Instead of having to wait for the banks to open or process transactions, member payments move instantaneously into your account. This is also just as convenient for members as they can receive instant refunds and better visibility on their payment history.

Why you should care:

- Lower processing fees: ACH and real-time payments often cost 1%-2% less than credit cards.

- Faster access to funds: Reduce the cash flow gaps that slow your growth.

- Positive member experience: faster transactions and more seamless member experiences.

Example: Visa announced a new round of credit card fee increases for 2025 — another reason to encourage ACH transactions.

Pro tip: Work with a fitness payments provider that offers flexible billing options like ABC Fitness.

#4: Time to Step Back From Credit Cards

Credit card fees are rising, and with credit cards accounting for most fitness transactions, businesses need a smarter strategy. In 2025, it pays to take your gaze away from the status quo and focus more on the future. Neobanks, digital wallets, ACH and real-time transfers can all provide you and your members with a better business experience.

Why you should care:

- Manage costs: Blending payment types (e.g., encouraging ACH payments) can lower your average processing fees.

- Protect your profits: If there’s a problem with one payment method, you can rely on a second to collect revenue.

Pro tip: Implement incentives for members who choose lower-cost payment methods.

Learn More: How ABC Ignite can offer you a seamless revenue collection experience

#5: Membership Models Are Evolving

It used to be that gym memberships were a set-and-forget business model. Now, annual contracts are declining in favor of flexible monthly or anniversary-based memberships. With new FTC guidelines coming in this year and a sentiment change in fitness behaviors, it pays to study your membership models and adapt to the times. Pay-as-you-go memberships or monthly recurring memberships are on the rise and can be significantly more profitable if done correctly.

Why you should care:

- Increase retention: Members stay longer when they feel less locked in.

- Boost cash flow: Monthly payments provide more predictable revenue.

- Flexible memberships for Gen Z: younger customers prefer a flexible or trial-based experience.

Industry Insight: Younger generations prefer to have more freedom when it comes to their memberships, so make sure not to lock them into older style contracts.

Pro tip: Design memberships that meet members where they are — flexibility wins loyalty.

#6: Modern POS Experiences Drive Upsells

Static front desks are out; mobile POS and seamless in-club experiences are the future. Think about a trainer at the end of a class upselling a membership to a new member, or a customer looking for a bottle of water or some merch on the gym floor; reducing the steps to closing a sale is the best method for increasing closing rates.

Why you should care:

- Upsell with ease: Mobile POS systems make it easy to upgrade memberships, sell PT packages, or sell merch during a class.

- Enhance convenience: Remove barriers to purchases equals more revenue.

Pro tip: ABC Fitness provides numerous payment and billing solutions.

#7: Intelligent Billing: Maximize Collections

Automation tools like account updaters, click-to-pay links, and AI-driven billing are no longer “nice-to-haves” — they’re essential. If you can automate your billing processes, not only can it save you time in collections, but also can significantly increase your revenue. Discover more capabilities when it comes to modern collection rates instead of focusing on more traditional methods.

Why you should care:

- Boost collection rates: ABC Fitness achieves up to 97% collection rates.

- Minimize manual tasks: Free your team to focus on member experience, not chasing payments.

Pro tip: Intelligent billing is the future — and it’s already here. Learn more about ABC Fitness’s seamless billing solutions below.

#8: E-commerce and Marketplace Integration

Fitness businesses are expanding into apparel, supplements, and beyond. As a fitness business, you need to look into how you can expand into merchandising and upselling your customers on vitamins, supplements, and even branded water bottles. This can significantly increase your monthly revenue, but it also means having seamless inventory and checkout systems.

Why you should care:

- New revenue streams: Don’t just sell memberships, sell the entire lifestyle.

- Simplify operations: Manage everything from one integrated platform.

Pro tip: ABC Fitness links your physical location, website, and mobile app into a unified commerce experience.

Billing and Payments Journey Best Practices

Now that you know some of the trends on the modern world of fitness business payments, it’s important for you to understand the billing journey and how you get your members through the payments process.

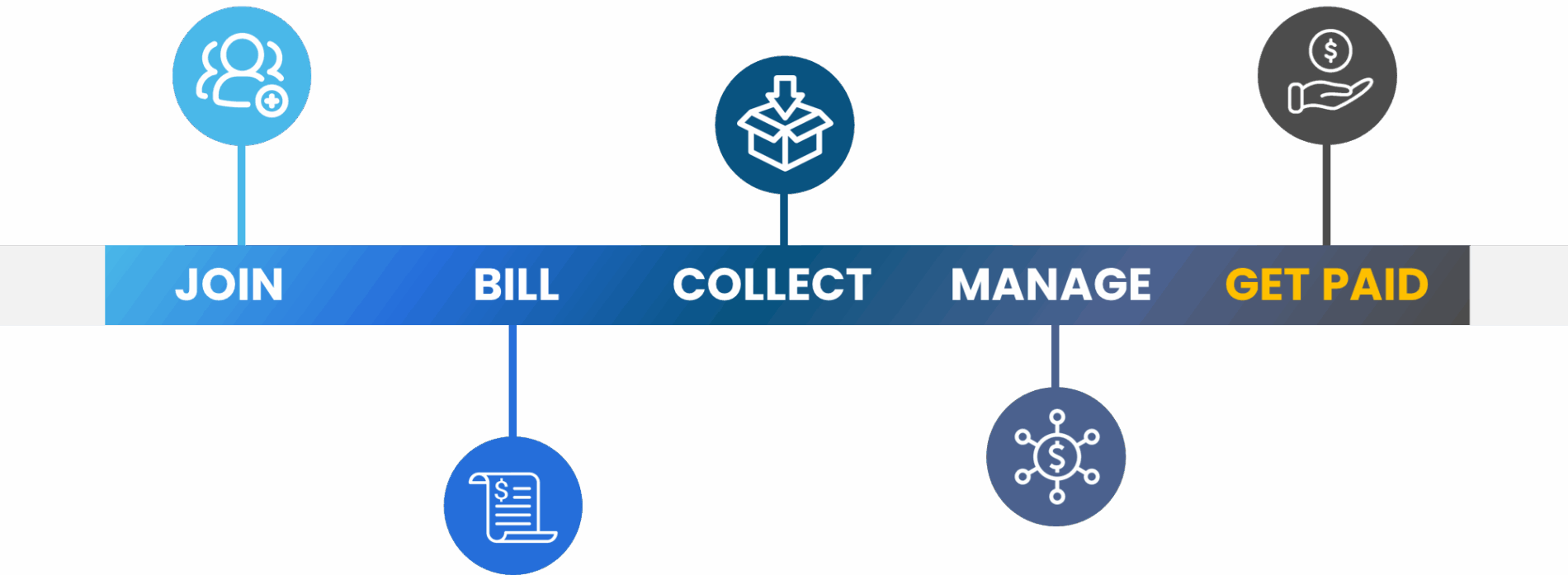

The billing journey has five stages, and success at each stage impacts your collections:

Join:

This is where your members’ journey begins, and first impressions count. Whether it’s through your website, mobile app, or in-person at your studio, making it easy for people to sign up is key. A smooth, fast, and intuitive sign-up process can significantly boost conversions and get more people through your doors. Enhance this experience even further by offering compelling price options, discounts, and promotions—such as multiple payment methods—making it easier for members to say yes and start their journey with you. Additionally, don’t forget that real-time payment authentication is quickly becoming the industry standard, so make sure your business is able to provide instantaneous payment validation to streamline your signup and payments process.

Pro Tip: One of the most effective methods of getting leads to join your gym or fitness business is through referrals and trials. By using ABC Fitness’s Acquire, you can easily set up referral and trial memberships for your business.

Billing:

Once a member decides to join, giving them flexible, secure ways to pay is non-negotiable. From credit cards to ACH and digital wallets, the more options you offer, the more likely they are to complete their purchase.

Convenience here, like flexible billing or multiple payment methods, translates to higher satisfaction and lower drop-off. Simple things like allowing members to choose the date and time of billing can make a huge difference in member experience and retention. Additionally, ensure you have a secondary payment method (like a credit card) stored on-file in case of failed payments. Members need to be able to easily manage their preferred payment methods—including primary and backup options—all under a single profile, with automatic updates ensuring their information stays current without added effort. Don’t forget other payment methods such as gift cards or credits; how will you store them? How will members access them?

Learn More: How ABC Ignite Streamlines Your Billing and Payments Experience

Collect:

It’s not just about setting payments, it’s about actually collecting them. Leveraging tools like automated billing, account updaters, and intelligent payment reminders helps you maximize collection rates. That means more predictable income and fewer awkward follow-ups.

It’s also important to remember member notifications; members are far less likely to miss a payment if you give them plenty of prior warning. Think of SMS, email, or push notifications for reminders, and even in-app alerts to remind members of past-due or upcoming payments.

There’s also one thing that’s inevitable when it comes to collections: missed payments. This is going to happen from time to time, and you need to be prepared for it. Ensure you have a solid and intelligent collections system that has access to secondary payment methods and can provide you with a ledger of past-due accounts and their contact details through club accounts.

Manage:

Managing your billing shouldn’t be a headache. With clear insights tools and centralized reporting, you can easily track income, spot issues early, and stay on top of your finances. Less time on admin, more time on growth.

It also happens that there comes a time when it pays to outsource your delinquent accounts for collection and create insights reports to understand why this occurs.

Additionally, having clear tax management workflows is vital, especially for larger businesses with thousands of members. Royalty payments can also be a hurdle for scaling franchises, something which needs to be streamlined for sustainable success.

Did you know? ABC Fitness is paired with collections agencies and tax management services that can streamline your billing management workflows, saving you time and money regardless of your business size.

Get Paid:

Finally, the most important part, actually getting the money in your account. Real-time payments and efficient banking integrations mean you don’t have to wait days to access your revenue. Faster deposits equal better cash flow and stronger business momentum.

Do you have a consistent payment schedule?

Do you know when your revenue will be deposited into your desired account?

You need to know exactly when your money is coming in and out, as irregular cashflow can become a major struggle for even the most profitable businesses.

For franchises, this becomes an even larger issue; do you have an automated royalty payment system? Can you track your royalties and fees business by business?

Also, do you have a resource for a quick injection of revenue? Having a rainy-day fund or a quick revenue resource is vital for your business success.

Learn More: RevenueNow offers the cash flow your business needs

ABC Fitness can provide you with all the above features and more, including early or daily deposits, automated settlements, and we will soon be offering capital loans to give you the cashflow you need to expand your business.

Looking to improve your business payment structure?

How ABC Fitness Helps You

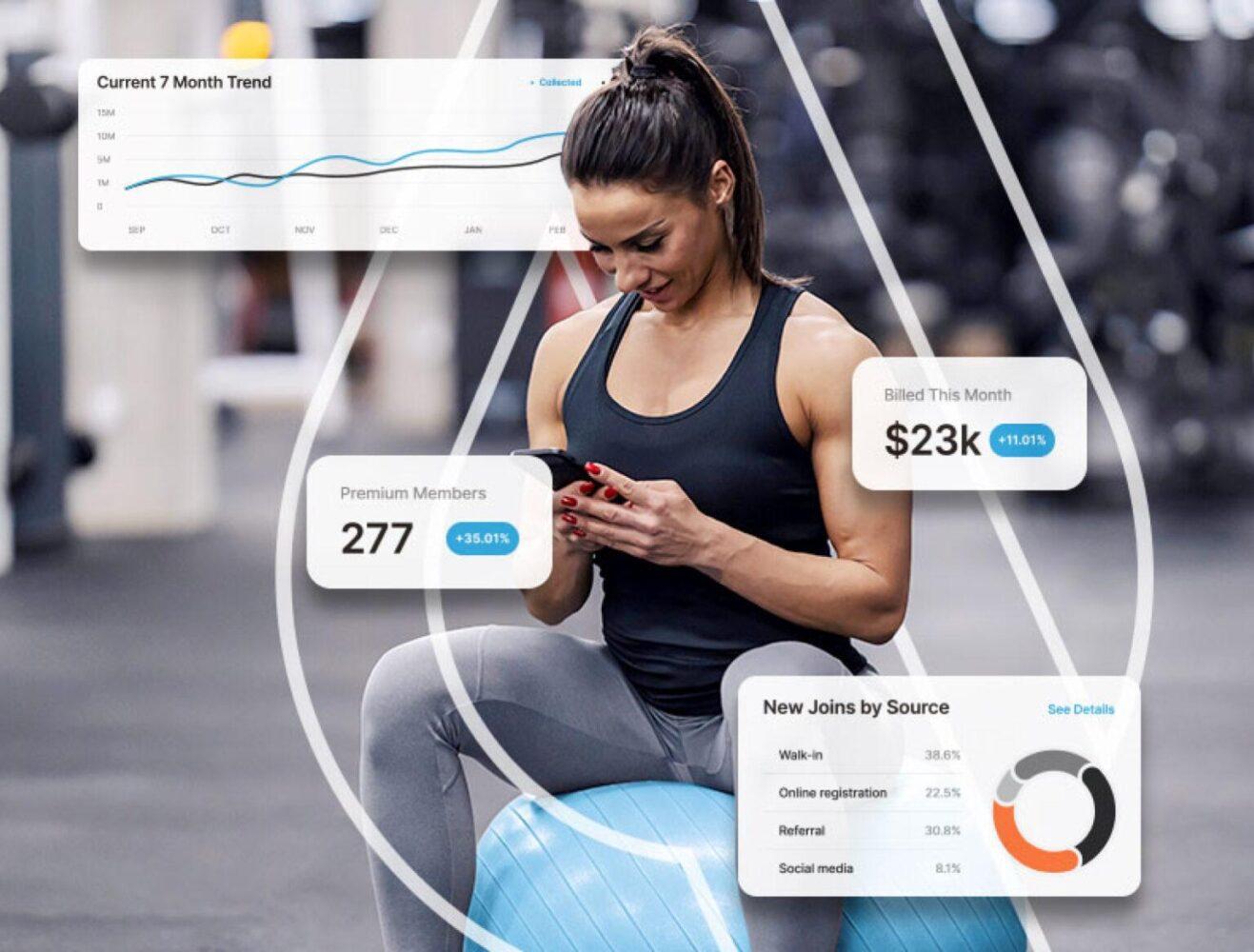

ABC Ignite is part of ABC Fitness, the world’s largest fitness membership management platform. For over 40 years, we have helped fitness businesses maximize revenue and create seamless payment systems that keep collection rates high and membership retention rates steady.

Today, ABC Ignite already provides industry-leading Revenue Cycle Management experience with 97% collection rates across 40M members in 100+ countries. Additionally, ABC Ignite also provides:

- Multiple payment and billing options

- Clear payment and revenue insights

- Up to 97% collection rate

- A branded app for in-app payments, member management, and credit packs

- SMS, email, and in-app communication for collections

- Outsourced collections and tax management services

- Royalty and franchisee capabilities

- Cashflow resources through RevenueNow

- Advanced and daily deposits

- Club accounts and automatic account updates

In the future, we will also be providing future focused payment features such as:

- Payment Links: Simplifying past-due collection and upsells with clear payment pathways.

- Upgraded Intelligent Billing: Smarter, AI-powered billing flows that increases collections and reduces admin time.

- Plaid Integration: Real-time ACH validation and updates for instantaneous payment capabilities.

- Capital Loans: Giving you the investment you need to expand your fitness business.

As we said at the very beginning, payments and billing are no longer a back-office function, they’re a business driver. With ABC Ignite, you can rest assured knowing your billing capabilities are backed up by the world’s largest fitness business payments platform with a 97% collection rate.

Learn more about ABC Ignite’s billing capabilities or request a demo.