The Hidden Revenue Leaks Killing Your Fitness Business (And the Data-Driven Fixes That Actually Work)

By Lee Robinson, VP of Sales, ABC Fitness

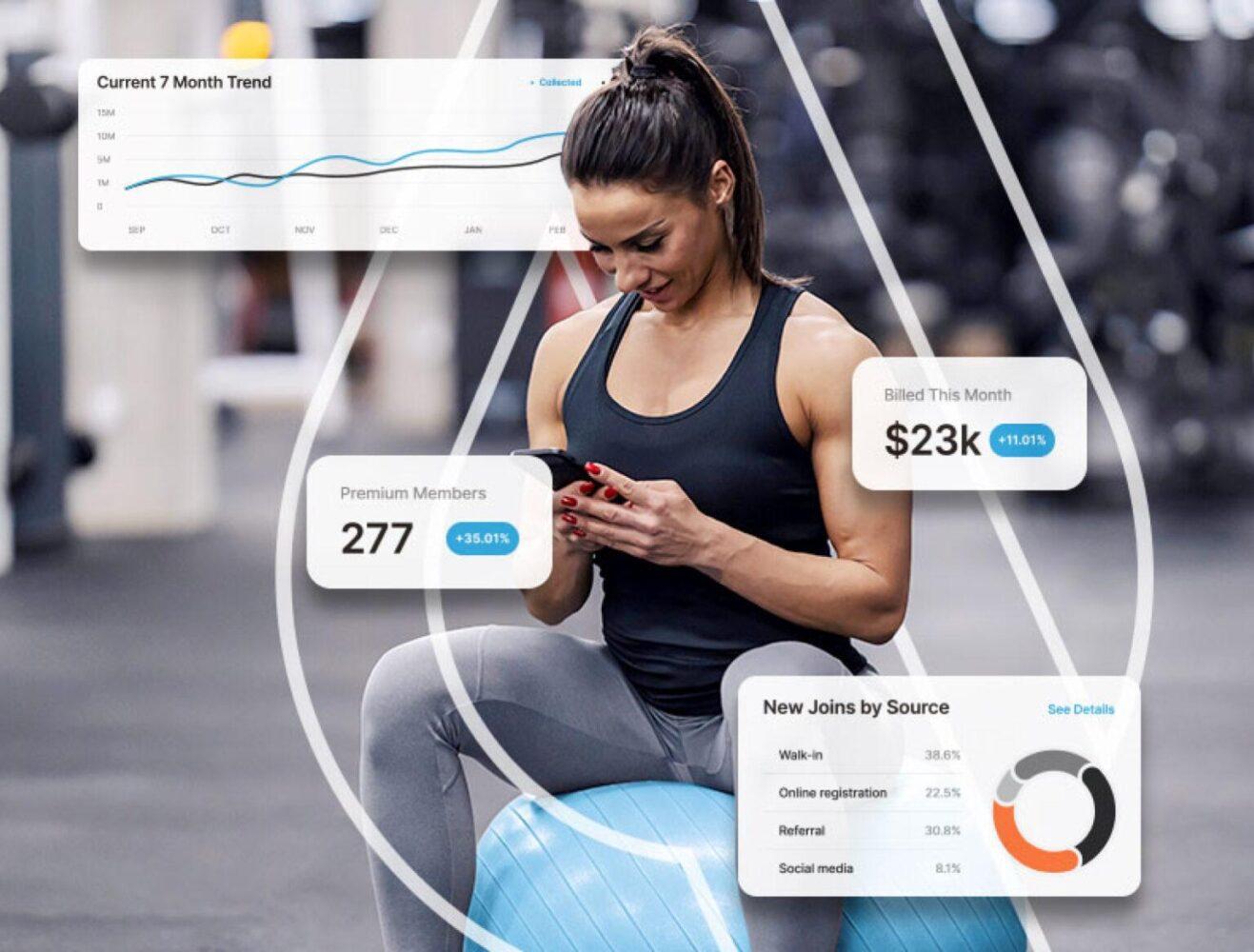

Most fitness operators focus on the wrong metrics. They obsess over membership numbers while ignoring the operational details that determine whether those memberships actually generate sustainable revenue.

After analyzing payment and operational data from 40 million members across 30,000 locations, I can tell you exactly where your money is leaking and how to stop it.

The 97% Standard You’re Not Hitting

Let’s start with a number that should be burned into every operator’s brain: 97% collection rate. That’s what’s achievable when you optimize your payment operations correctly. Most operators hover around 85-90% and accept it as “normal.”

That difference isn’t rounding error. On a $1 million annual revenue base, moving from 85% to 97% collections adds $120,000 directly to your bottom line. No new members required.

Here’s what our data reveals about payment optimization:

Optimal Payment Mix: 90% bank direct debit, 10% card payments. This isn’t theory – it’s what actually works across our entire network. Bank direct debit consistently outperforms card payments across all collection cycles.

Billing Day Impact: Friday billing shows a +1.02% improvement in collection rates compared to other days. Small improvement, but when applied to thousands of transactions, it’s real money.

Collection Strategy Effectiveness: Revenue recovery strategies add 7-10% lift in collections across our portfolio. The breakdown:

- Primary billing: 90% collection rate

- Automated reattempts: 3% additional recovery

- Web/mobile recovery: 3% additional recovery

- In-club intervention: 3% additional recovery

The Annual Fee Opportunity You’re Ignoring

39% of operators utilize annual fees, but most implement them incorrectly. Our data shows the optimal approach:

Timing: Charge annual fees 60-90 days after initial signup, not immediately. Member commitment is highest after they’ve established a routine.

Amount: $52 average across our network, but this varies dramatically by market and positioning.

Billing Method: 77% of successful annual fees are billed based on member join date rather than calendar dates. This spreads cash flow and reduces seasonal impact.

Big Box vs. Boutique: Large operators are significantly more likely to successfully implement annual fees because they have the systems to manage date-based billing complexity.

The Mobile Revenue Channel You’re Underutilizing

Mobile app engagement directly correlates with revenue recovery and member retention. Across our network:

- 405,000 past-due payments recovered via mobile apps

- 224,000 referrals generated through app features

- 92,000 new prospect signups via mobile platforms

- Average 70-second app session time drives measurable revenue impact

But here’s what most operators miss: mobile apps aren’t just member convenience tools. They’re revenue recovery and growth engines when built correctly.

Habit Tracking Revenue Impact: Members who track habits through mobile apps show 30% higher retention rates. Our network processes 30 million habit completions annually, directly tied to membership tenure.

Digital Coaching Integration: 84 million workouts tracked and 292 million meals logged create engagement patterns that predict member behavior 3-6 months in advance.

The Cancellation Pattern That’s Costing You Millions

Most operators think price is the primary cancellation driver. Our data tells a different story:

Top Cancellation Reasons (Real Data):

- Collections issues: 20.95%

- General cancellation requests: 9.56%

- Membership expiration: 9.12%

- Insufficient usage: 7.87%

- Time constraints/no usage: 6.81%

The number one reason members cancel isn’t dissatisfaction with service, it’s payment problems. Fix your billing operations, reduce your churn. It’s that direct.

Generational Attrition Patterns:

- Generation Alpha: 59.13% attrition

- Gen Z: 54.42% attrition

- Millennials: 46.77% attrition

- Gen X: 37.05% attrition

- Baby Boomers: 26.48% attrition

- Silent Generation: 21.45% attrition

The pattern is clear: younger demographics have higher engagement potential but require different retention strategies. The operators who figure this out first capture disproportionate value.

Billing Frequency Intelligence

Monthly billing dominates (61% of operators), but our data reveals optimization opportunities:

Bi-weekly Billing Growth: Increased from 9% to 11% across our portfolio. Members perceive smaller, more frequent payments as more manageable, improving collection rates.

Calendar-Based Billing: 24% adoption rate, particularly effective for smaller operators managing cash flow. Predictable billing dates simplify operations and improve financial planning.

Member Join Date Billing: 40% of operators use this approach, showing superior collection performance because billing dates are distributed throughout the month.

The Digital Wallet Revolution

Payment method preferences are shifting rapidly:

- 50% of global e-commerce transactions use digital wallets

- 30% of point-of-sale transactions now digital

- 72% of Gen Z already use neo-banks

Most fitness operators aren’t prepared for this shift. Credit card processing remains dominant, but members increasingly expect Apple Pay, Google Pay, and emerging fintech integration.

The operators preparing for this transition will capture the digital-native demographic more effectively.

Predictive Analytics in Action

Our AI models, trained on 40 million member behaviors, identify patterns invisible to traditional analytics:

Churn Prediction: We can identify members likely to cancel 30-60 days before they actually do, enabling proactive retention interventions.

Revenue Optimization: Predictive models suggest optimal pricing for different demographic segments and geographic markets.

Usage Pattern Analysis: Members who attend group fitness classes within their first 30 days show 40% higher retention rates across all age groups.

Technology Infrastructure That Actually Drives Revenue

Most operators ask about the latest fitness technology. The reality is that basic operational technology drives more revenue than flashy member-facing features:

Payment Processing Optimization: Intelligent retry logic and payment method routing improve collection rates more than any member app feature.

Automated Communication: Triggered messages based on behavior patterns (not attendance, but payment and engagement patterns) drive retention.

Integration Systems: Seamless data flow between billing, access control, and member management systems eliminates the operational friction that causes revenue leaks.

Five Immediate Actions for Operational Excellence

1. Audit Your Collection Rate by Payment Method Pull 90 days of data. Calculate exact collection rates for bank vs. card payments. If you’re not hitting 95%+ overall, you’re leaving money on the table.

2. Test Friday Billing for New Members Run a 60-day A/B test. Our data shows consistent improvement but test it in your market.

3. Implement Annual Fee Strategy If you don’t have annual fees, you’re potentially missing 15-20% additional revenue. Start with new members, grandfather existing ones.

4. Map Your Cancellation Reasons Track actual reasons for 30 days. If collections issues rank in your top 3, fix your billing before spending money on retention programs.

5. Measure Mobile App Revenue Impact Track payments made through mobile apps, referrals generated, and retention rates for app users vs. non-users.

The Competitive Advantage

The fitness industry is becoming a data business that happens to involve physical spaces. Operators who understand this win. Those who don’t become commodity providers competing on price alone.

Our network processes $12 billion annually because we’ve learned that operational excellence at scale requires data-driven decision making. The insights aren’t secrets – they’re sitting in your own systems. The question is whether you’re extracting and acting on them.

What’s Coming

The next 18 months will separate operators who run data-driven businesses from those who rely on intuition and industry folklore.

Immediate trends to prepare for:

- Accelerating shift to digital payment methods

- Increasing demand for predictive analytics and automated operations

- Growing importance of mobile-first member experiences

- Rising expectations for personalized pricing and billing options

Strategic questions for your business:

- What percentage of your revenue could you increase just by optimizing collections?

- How much are you spending on member acquisition vs. optimizing revenue from existing members?

- What operational inefficiencies are you accepting as “normal” that technology could solve?

- How would your business change if you could predict member behavior 90 days in advance?

The fitness industry has more data than ever before. The operators who turn that data into operational advantages will dominate the next decade.

The choice is simple: evolve your operations or get left behind by operators who do.

These insights come from analyzing 40 million member interactions across 30,000+ fitness locations processing $12 billion in annual transactions. The patterns are measurable, the solutions are implementable, and the competitive advantage is available to operators ready to embrace data-driven operations.