Fortune 500 AI Reality Check: Why Gym Operators Must Fix the Plumbing Before Buying the Tools

By Lee Robinson, VP of Sales, ABC Fitness

Most enterprises are piloting AI, but only a minority translate spend into measurable ROI. MIT research shows that about 95% of generative AI pilot programs are failing, with only 5% achieving rapid revenue acceleration. For gym operators, the lesson is clear: start with data and workflows, then pick a few high-leverage use cases that directly cut costs or lift revenue, and fund frontline enablement from day one.

The priority is not “buy a model”: it’s “fix the plumbing,” define the jobs to be done, and train the people who actually run your clubs. Companies that purchase AI tools from specialized vendors succeed about 67% of the time, while internal builds succeed only one-third as often. Expect disciplined programs to outperform spray-and-pray tooling by 2x on ROI.

1) What the Big Companies Are Actually Seeing

The spending numbers are eye-watering. In 2024, organizations worldwide spent an estimated $235 billion on AI, and tech giants like Meta, Amazon, Alphabet, and Microsoft plan to spend as much as $320 billion combined in 2025. Yet more than 80% of enterprise AI projects fail to deliver meaningful business value.

McKinsey’s 2025 State of AI shows usage is now mainstream, with 78% of organizations using AI somewhere, and 71% regularly using generative AI in at least one function. Adoption is up; impact is uneven.

BCG’s research finds only about one quarter of companies have the capabilities to move beyond pilots and create tangible value at scale. IBM’s 2025 CEO study reports only 25% of AI initiatives delivered expected ROI over recent years, and only 16% scaled enterprise-wide. Translation: many proofs-of-concept do not survive contact with legacy data, processes, and culture.

Even industry leaders struggle. Only 11% of enterprise CIOs say they’ve fully implemented AI, despite 99% of Fortune 500 companies utilizing AI technologies. Salesforce’s leadership has acknowledged that innovation is outpacing customer adoption because re-plumbing large architectures is hard.

There are successes, but they look like focused, workflow-native systems. Bank of America’s “Erica” platform generated over 2.7 billion interactions after a decade of iterating around specific customer jobs, and the bank achieved more than 50% reduction in IT service desk calls and 20% increase in developer productivity.

2) The Frontline Constraint You Must Plan For

Here’s the insight that should alarm every gym operator: your biggest AI investment isn’t technology—it’s the front-line workers earning just above minimum wage who will determine whether it succeeds or fails.

When a Fortune 500 software company implemented AI tools in its call center, newer and less experienced agents saw a 34% increase in productivity—but this required proper training and change management. BCG’s “AI at Work” research finds a “silicon ceiling,” with only about half of frontline employees regularly using AI tools. UKG’s global frontline studies show mixed readiness without explicit training and change management.

Only about one-third of companies in late 2024 prioritized change management and training as part of their AI rollouts, yet organizations that do invest in culture and change see much higher adoption rates.

3) Should You “Get Your Data House in Order” Before Tools?

Yes: In Parallel, Not in Sequence.

The data is damning: While 91% of professionals agree that having a reliable data foundation is essential to successfully adopt AI, only 55% say their organization’s data foundation is reliable. Worse, while 97% of Salesforce customers collect diverse data, only 24% effectively leverage it to transform customer experiences.

As Harvard Business Review notes, “data maturity necessarily comes before AI maturity”. Banks that have yet to defragment and modernize their tech stacks, clean up and manage their data, and integrate data to drive decisions will likely face challenges in their AI implementations.

Fortune 500 lessons are clear: The winners do fewer use cases, go deep, and invest early in data quality, workflow changes, and workforce skills. That combination yields roughly 2.1x the ROI of peers. For operators, that means modernizing data paths while piloting two or three pragmatic use cases—not waiting for a perfect warehouse.

4) A Gym-Operator-Specific Playbook That Works

Start with the jobs that move P&L fast.

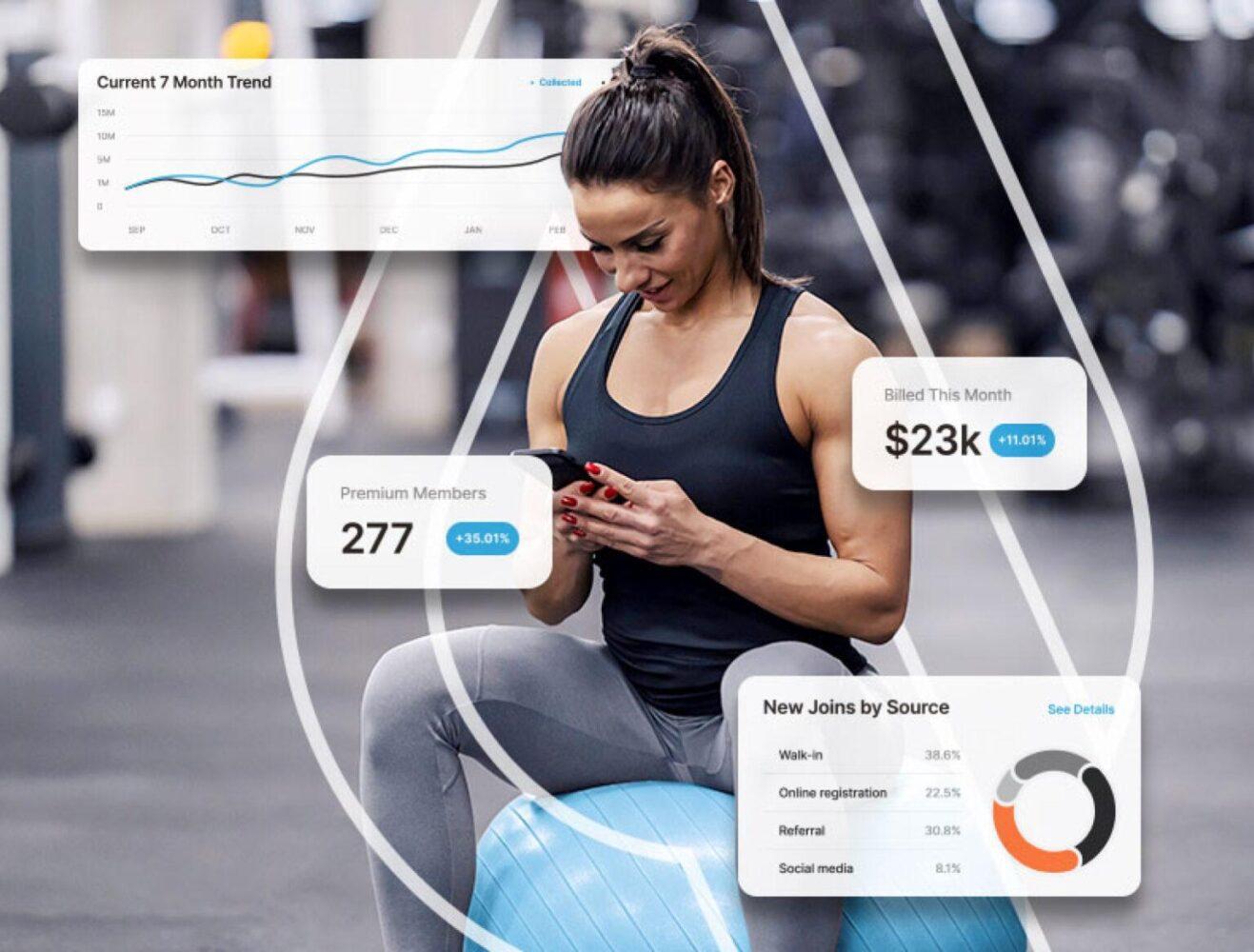

Based on cross-industry evidence, the most reliable value sits in customer operations, marketing and sales, and workforce management. For clubs and studios, that maps to: collections and billing success, churn prevention, schedule and labor optimization, and lead-to-tour-to-join conversion.

Anchor on a few, not many. Pick three use cases, build them into the workflow, and measure to cash:

- Intelligent billing and collections with flexible windows and smart retries, plus proactive notifications, to reduce payment failures and reprocess when funds are available. Expected impact: 8–20% lift in first-attempt recovery, assuming clean payment data and clear retry logic. Evidence base: customer operations is a top value area in McKinsey’s analyses.

- Churn risk scoring with targeted outreach using attendance, tenure, and ticket data to trigger saves. Expected impact: 5–12% reduction in voluntary churn among at-risk cohorts over 6–9 months. Evidence base: marketing and service ops are high-value AI domains; realized gains depend on offer quality and staff follow-through.

- AI-assisted scheduling and labor mix to match staff to demand by hour and class type. Expected impact: 2–5% labor-to-revenue efficiency gain in 90–120 days , with higher upside in multi-site operations that currently schedule by habit.

- Fund frontline enablement like a product launch. Budget time for simple SOPs, five-minute micro-lessons, and manager scorecards. Without this, adoption stalls even if the model is perfect. BCG’s “silicon ceiling” finding is the cautionary signal.

- Operate a value office, not a lab. Assign an owner for each use case, define pre-commit success metrics, run 6–8 week sprints, and require a scale-or-stop decision. IBM’s CEO study shows lack of scale is the failure mode; treat scaling as the product.

5) Forecasts and Confidence

If you execute the three-use-case stack above across a 5–10 location operator, you should target a first-year EBITDA uplift of 3–6%

Method: bottom-up contribution from billing recovery, churn saves, and labor efficiency, bounded by published ranges for AI value in customer operations and workforce scheduling, and tempered by IBM’s finding that only one in four initiatives meet expected ROI without disciplined scaling.

Action List: Immediate Next Steps (30 Days)

- Name your three use cases and write one sentence for the member or staff job each solves. Tie each to a single KPI and a cash proxy.

- Stand up a lightweight data pipeline for those use cases only—not a boil-the-ocean warehouse. Establish trusted sources for attendance, billing, offers, and staffing.

- Frontline enablement plan with five micro-lessons, one SOP per use case, and manager weekly reviews. Budget two hours per staffer to launch.

- Value office cadence with 8-week pilots, pre-registered success metrics, and a scale-or-stop gate.

Decision Matrix for Tool Selection

| Criterion | Weight | Option A: Point App | Option B: Platform Add-on | Option C: Build with Services |

| Workflow fit for frontline | 30% | Often strong if purpose-built | Varies by module | Customizable, needs product owner |

| Time to value | 25% | Fast | Fast if data native | Medium, depends on data |

| Data plumbing required | 20% | Low to medium | Low inside vendor stack | Medium to high |

| Total cost, 12 months | 15% | Subscription plus change mgmt | Bundled, watch for lock-in | Services plus infra |

| Ability to scale to next use case | 10% | Medium | Medium to high | High if standards enforced |

Pick the option that wins on “workflow fit” and “time to value” for your top two use cases, and only then optimize for cost. The Fortune 500 lesson is that architecture comes second to adoption and measurable outcomes.

The Bottom Line

The AI gold rush is real, but so is the wreckage. With enterprise AI deployments costing anywhere from $5 million to $20 million, and 30% of generative AI projects predicted to be abandoned after the proof-of-concept stage by the end of 2025, the stakes couldn’t be higher.

For gym operators, the winning strategy isn’t about being first to every new AI tool. It’s about being disciplined: fix your data foundation, pick high-impact use cases, train your frontline teams, and measure relentlessly. The companies that do this will capture 2x the ROI of competitors chasing shiny objects, while spending half as much.

Sources:

- MIT NANDA Initiative: State of AI in Business 2025

- McKinsey: State of AI 2024-2025

- BCG: AI at Work and scaling research 2024-2025

- IBM Institute for Business Value: 2025 CEO Study

- Harvard Business Review: Data Readiness for AI Revolution

- Gartner & IDC: AI market sizing and adoption research

- Bank of America, Salesforce: Public case studies and earnings reports

Ready to future-proof your fitness business?

See how ABC Fitness can help you turn data into growth.

👉 Request a Demo and start shaping the member experience of tomorrow, today.