The Demographic Earthquake That’s Reshaping Fitness (And Why Most Operators Are Missing It)

By Lee Robinson, VP of Sales, ABC Fitness

We’re sitting on the largest dataset in the fitness industry, 40 million of North America’s 72 million gym members flow through our network. What we’re seeing should fundamentally change how you think about your business.

The numbers tell a story that most operators aren’t ready to hear: the fitness industry isn’t just changing, it’s experiencing a complete demographic inversion. And if you’re not adapting, you’re not just losing market share – you’re becoming irrelevant.

The 54% Reality

Let me start with the number that might keep you awake tonight:

54%* of new gym memberships are now Gen Z. Not Millennials. Not Gen X. Generation Z – people born after 1997.

This isn’t a trend. This is a fundamental shift in who your customer is.

Across our 40 million-member dataset, we’re tracking behavioral patterns that reveal just how different these members are:

- They’re willing to carry debt for fitness (41%* have done it)

- They use neo-banks at a 72%* rate

- They expect digital-first everything, yet 68%* prefer working out alone

- They have the highest attrition rates (54.42%*) but also the highest engagement when properly served

Meanwhile, Baby Boomers show 26.48%* attrition rates with longer membership tenure, but they only represent 42%* of the population using fitness facilities.

Here’s the mathematical reality: you can either learn to serve the high-volume, high-engagement Gen Z market, or you can optimize for the stable but shrinking Boomer segment. You can’t do both with the same approach.

The $244 Billion Question

The global fitness industry hit $244 billion in 2024, growing at 8.83% CAGR. But that growth isn’t distributed evenly. Premium operators are capturing disproportionate value while budget operators fight over shrinking margins.

Look at the public market performance:

- Planet Fitness: 5.3% revenue growth, first price increase in 25 years

- Fast-growing studio chain: Doubling footprint but revenue per site slipping, exposing the cracks of scaling without performance visibility

The data reveals a clear pattern: operators who understand and serve changing demographics are winning. Those who don’t are stagnating.

What Our Data Predicts About Member Behavior

Here’s where it gets interesting. Our predictive models, trained on 40 million member interactions, show patterns that most operators can’t see because they lack the dataset.

The real technology question isn’t “What’s the coolest new thing?”; it’s “What boring, unsexy operational improvements will actually move my revenue?”

Retention Predictors by Generation:

Gen Z members are 73%* more likely to stay if they:

- Complete mobile app onboarding within 72 hours

- Participate in group fitness within 30 days

- Connect with other members through digital features

Millennials (72% gym membership rate) respond to:

- Flexible scheduling options

- Hybrid digital/physical experiences

- Lifestyle integration features

Gen X (55% membership rate) optimize for:

- Efficiency and convenience

- Stress relief programming

- Time-saving technology

The Spending Reality

The economic data contradicts conventional wisdom about price sensitivity. Gen Z and Millennials drive 60%* of discretionary fitness spending growth despite carrying higher debt loads. They view fitness as essential, not discretionary.

Our payment processing data across $12 billion in annual transactions shows:

- Higher-priced memberships have better retention rates

- Premium service adoption is significantly higher among younger demographics

- 38%* of Millennials and 41%* of Gen Z have carried fitness-related debt

This creates a paradox: the demographic with the highest debt tolerance also has the highest attrition rates. The key is understanding what they value.

Technology Isn’t Optional Anymore

Digital fitness is growing at 33.1% CAGR, projected to hit $59 billion by 2027. But here’s what most operators miss: it’s not about replacing physical spaces. It’s about creating seamless hybrid experiences.

Our data shows 72%* of Gen Z use both gym and home workouts. Virtual class participation is up 311% post-COVID, but 35% of Americans started in-person classes after trying virtual first.

The winning formula isn’t digital OR physical. It’s digital AND physical, integrated in ways that feel natural to digital natives.

The Corporate Wellness Goldmine

B2B fitness contracts are up, but most operators are still thinking like B2C businesses. Corporate wellness programs are growing, and companies are looking for measurable outcomes, not just gym access.

The businesses writing the biggest checks want:

- Biometric tracking and reporting

- Stress reduction and mental health programming

- Productivity metrics tied to wellness engagement

Regional Market Intelligence

Population growth patterns favor suburban and secondary markets:

- Sunbelt states (Austin, Nashville, Phoenix, Tampa) showing strongest growth

- Suburban migration continues post-pandemic

- Tech hubs with high millennial/Gen Z concentration offer premium pricing opportunities

Urban premium clubs maintain pricing power, but the volume growth is happening in suburban markets with lower real estate costs.

Five Questions Every Operator Should Ask This Week

1. What percentage of your new members are under 30? If it’s less than 50%, you’re not capturing the growth demographic.

2. How long does your mobile signup process take? If it’s more than 3 minutes, you’re losing Gen Z prospects.

3. What’s your revenue per member by age group? If younger members aren’t generating higher lifetime value, your pricing model is broken.

4. How many corporate wellness contracts do you have? If the answer is zero, you’re missing the fastest-growing revenue segment.

5. Can you predict which members will cancel next month? If not, you’re operating blind in a data-rich environment.

The Next 18 Months

The consolidation is already happening. Not through acquisitions, but through member migration to operators who understand changing needs.

Our predictive models show three distinct paths forward:

- Path 1: Premium Positioning – Follow the Life Time model with comprehensive wellness offerings, higher price points, and demographic-specific programming.

- Path 2: Hybrid Innovation – Blend physical and digital experiences seamlessly, targeting tech-savvy demographics with convenience and flexibility.

- Path 3: Specialization – Become the absolute best at serving one specific demographic or need, rather than trying to be everything to everyone.

The operators who try to be middle-market generalists are the ones our data shows struggling with retention and revenue growth.

What Success Looks Like

The fitness businesses thriving in our network share common characteristics:

- They understand their primary demographic deeply

- They use technology to enhance rather than replace human connection

- They deliver measurable value beyond equipment access

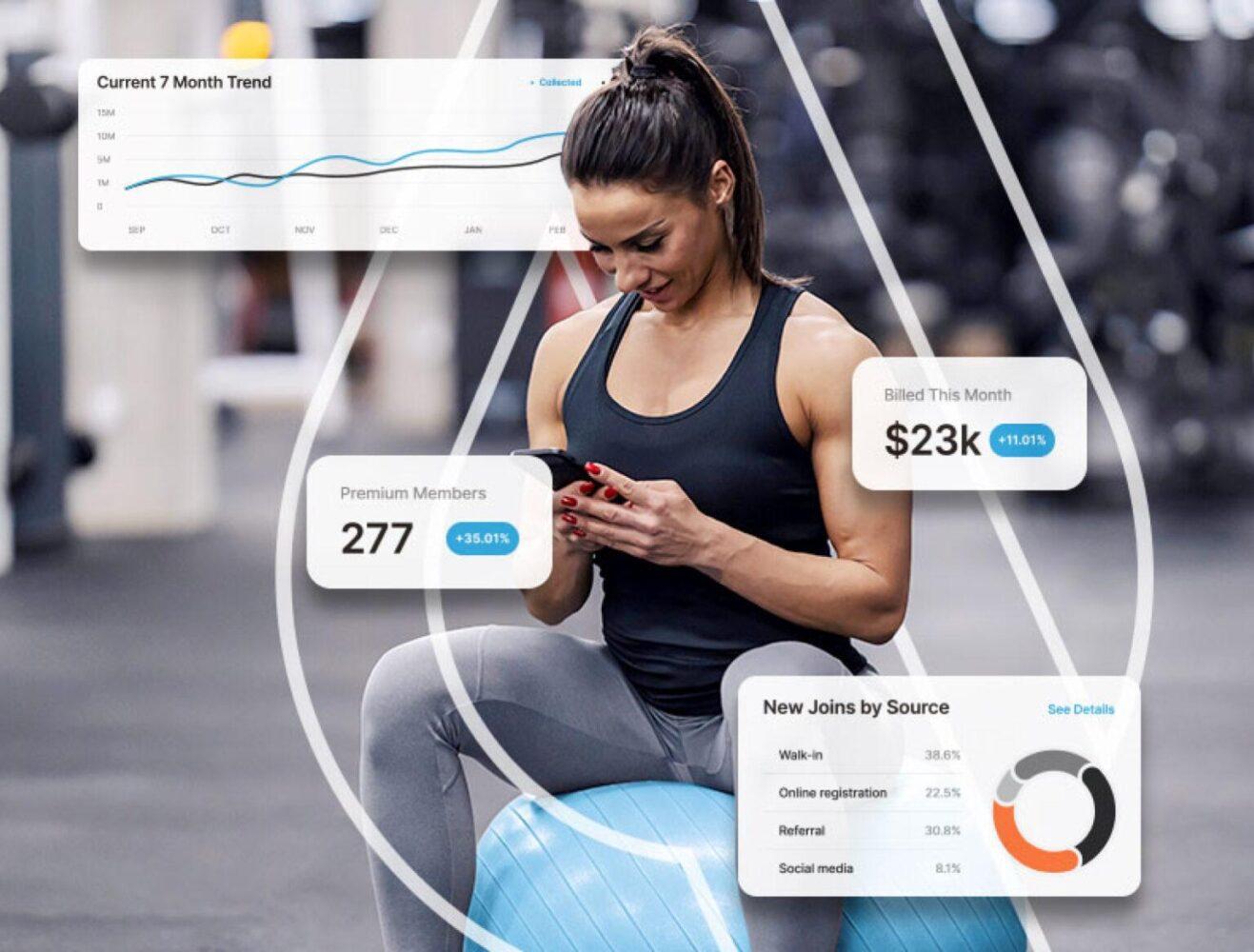

- They view data as a competitive advantage, not just reporting

The question isn’t whether change is coming. It’s whether you’ll use data to drive decisions or continue operating on assumptions that no longer match market reality.

Your members are telling you what they want through their behavior. The question is: are you listening?

Lee Robinson analyzes fitness industry data across a network of 30,000+ locations serving 40 million of North America’s 72 million gym members. These insights come from real behavioral data and predictive analytics, not surveys or projections.

*Cited from proprietary ABC Fitness data

Ready to future-proof your fitness business?

See how ABC Fitness can help you turn data into growth.

👉 Request a Demo and start shaping the member experience of tomorrow, today.