Transforming Wellness: The PHIT Act’s Journey Towards a Healthier America

Our CEO Bill Davis shares what the PHIT Act is, its overwhelmingly positive impact on the industry, and how key leaders recently met with policymakers on Capitol Hill.

Back in October I had the honor of joining other leaders in the fitness industry and members of The International Health, Racquet & Sportsclub Association?s (IHRSA) Industry Partner Advisory Council, who met in Washington, D.C. for an advocacy summit to meet with legislators to champion the benefits of the Personal Health Investment Today Act, or PHIT Act as it is known.

It was a remarkable experience in pursuit of an important piece of legislation that can boost the fitness industry, reduce the nation?s healthcare costs, and improve the health of countless millions.

Over 60 influential fitness industry figures gathered on Capitol Hill to engage in substantive discussions with Senators and Congressional Representatives on the size and impact of the fitness industry on the local and national economy, the importance of fitness and its role in preventative healthcare, and how we all have an opportunity to play a greater role in promoting the tangible benefits of fitness and preventative care.

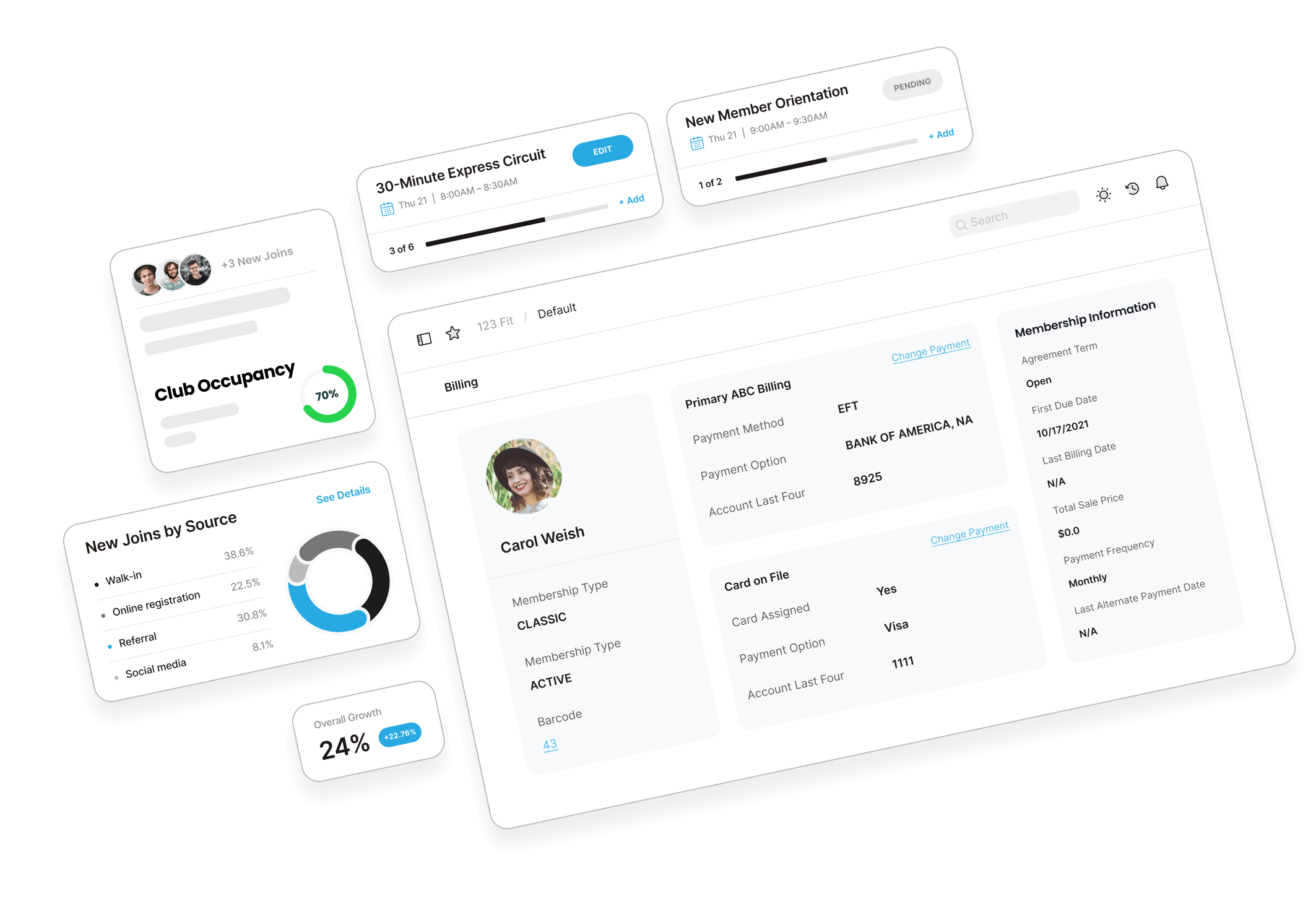

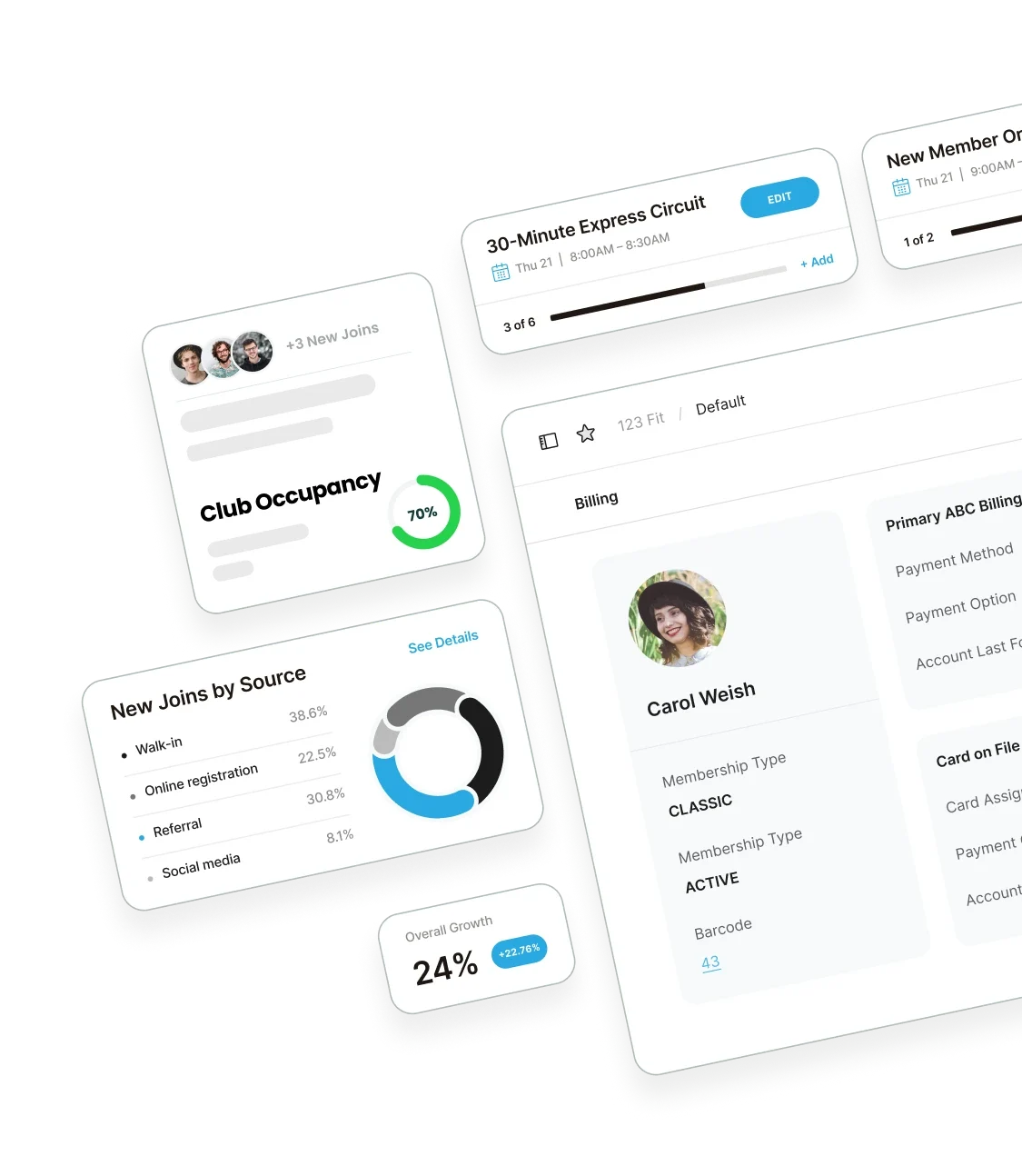

The goal was to encourage legislative support to incentivize people to make smart health and fitness decisions and to promote and reward investments in personal health. To this end, the PHIT Act aims to provide financial incentives for people to maximize their fitness journeys, which is the core mission of ABC Fitness and our customers.

What is the PHIT Act:

The Personal Health Investment Today (PHIT) Act is federal legislation aimed at incentivizing physical activity. If passed, it enables flexible spending accounts (FSAs) and health savings accounts (HSAs) to cover expenses related to activities and equipment that promote physical activity, exercise, and wellness. It would allow individuals up to $1,000 per year (or $2,000 for families) of pre-tax dollars to be spent on items such as:

- Gym & Health Club Memberships

- Youth & Adult Sports League Fees

- School Pay-to-Play Sports Fees

- Preparadores personales y

- Bike Rentals

- Sports & Fitness Equipment

- Sport-Exclusive Footwear

- Tournament & Race Registration Fees

- Youth Camps

- Fitness Tracking Devices

The PHIT ACT is intended to be used for spending on?expenses for the sole purpose of being physically active. The proposed bill also places a limit of $250 on any single piece of equipment and disqualifies expenses relating to sailing, horseback riding, hunting, or golf. Again, in order to keep the focus on activity, books and videos are also excluded.

Originally introduced in 2018, the PHIT Act has enjoyed bipartisan support. However, while it gained initial House approval, it faced delays in the Senate. Recently, in March 2023, Representative Mike Kelly y Senator John Thune reintroduced the initiative (H.R. 1582 and S. 786), and our recent visit was convened to reinforce the industry?s commitment to its passage. It is worth noting that the PHIT Act enjoys bipartisan support as it continues to gain traction in both the House and Senate.

Not only will this be a major catalyst for growth for the industry, but it also has the potential to lower healthcare costs for the nation.

Importance of the PHIT Act:

Recognizing the essential role of physical activity in both physical and mental health, the PHIT Act addresses a critical need. Among the millions of active consumers in the U.S., 2 in 5 cite exercise as a means to support their mental well-being. The Centers for Disease Control and Prevention (CDC) underscores that insufficient physical activity can lead to heart disease and increase the risk of chronic medical issues, such as obesity, high blood pressure, high cholesterol, and type 2 diabetes, even in individuals with no other risk factors.

With its provisions to include expenses relating to school sports fees and youth clubs, the PHIT Act is very much focused on helping families and encouraging a healthy lifestyle from an early age. Since the average annual income of an individual or family that uses an FSA or HSA is around $60K, the PHIT Act is also very much designed to help middle America, rather than only those at the top of the economic scale, even its widespread potential benefits.

Advancing Industry Advocacy

What struck me during our meetings was the surprising lack of understanding about the size and impact of the fitness industry as local employers, tax contributors and the role it plays in serving the health and wellbeing of our communities. So, during our time on Capitol Hill, we focused on a two-fold effort.

First, we shed light on the fitness industry?s significant impact on the economy and the growing trend of people prioritizing their physical and mental health post-pandemic. We highlighted the industry?s resilience through the pandemic and its crucial role in the post-pandemic era, where health and wellness are paramount.

Second, we addressed the lack of awareness and understanding about the PHIT Act itself, emphasizing its sensibility and potential benefits. While there was general appreciation for its sensibility, concerns were raised about its cost and whether it would benefit a specific class. Our task was to articulate the inherent benefits of the legislation and address these concerns, emphasizing that it is about providing more options for the X million individuals who have an FSA or HSA account, so they have an opportunity to use their rightfully earned pretax dollars.

One key point we emphasized was the significant amount of money?several hundred million dollars annually? forfeited by individuals with unused FSA and HSA funds, which benefit corporations. The PHIT Act, we argued, is about empowering constituents to reclaim these funds for their personal health and wellness activities.

What Can You Do to Help?

As Board Chair of the IHRSA Industry Partner Advisory Council, I have witnessed and have the opportunity to help shape the collective industry?s activities to champion this proposed legislation. Our goal is to garner support within the House and Senate, enhancing the PHIT Act?s chances of being incorporated into a larger financial bill.

However, advocating for the fitness industry should be the responsibility of all of us involved in it. So please get involved! Contacting your local Congress Representative or Senator is a great first step, and it could not be easier.

To help, IHRSA has created several resources to put you in touch with legislators. As a fitness professional, you can make your voice heard with a ready-made response that can be accessed here. You can also encourage family, friends, and your customers and clients to do the same with an individual note to representatives that can be accessed here.

With everyone?s help, we can get this bipartisan legislation over the finish line. Let us do it together!