We are ABC Fitness

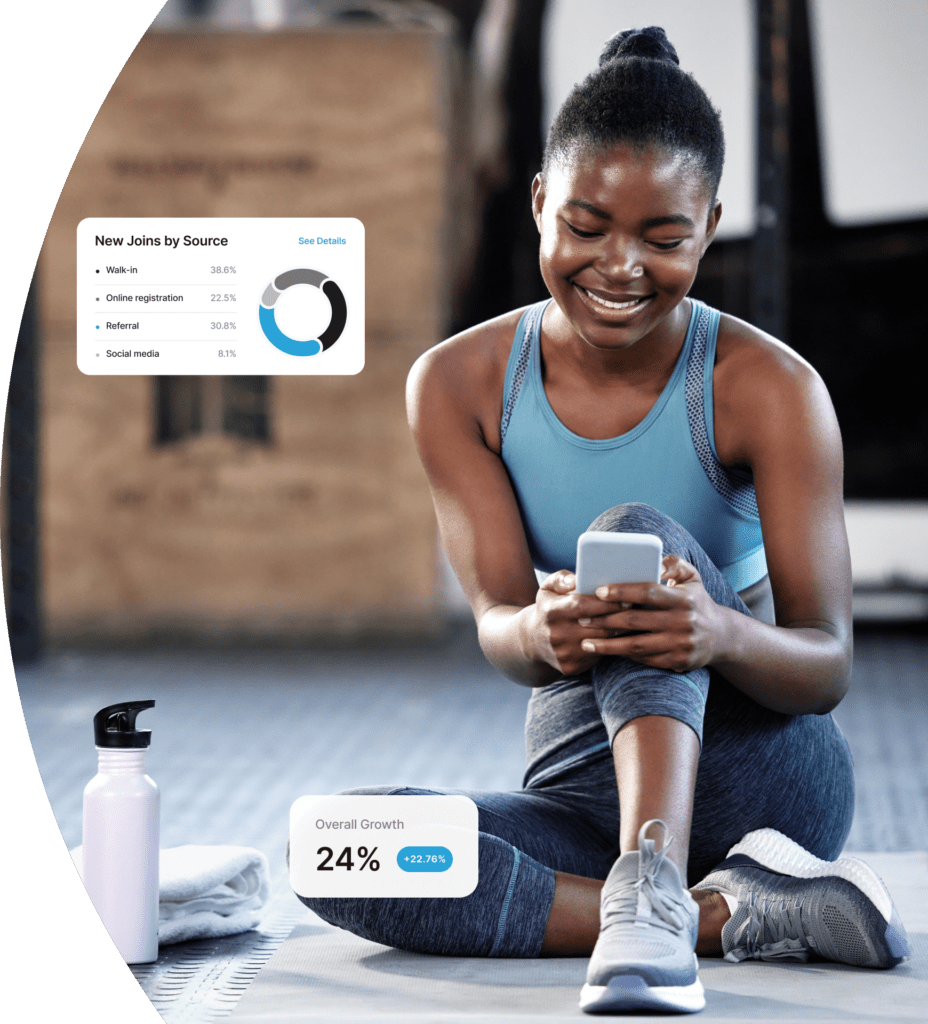

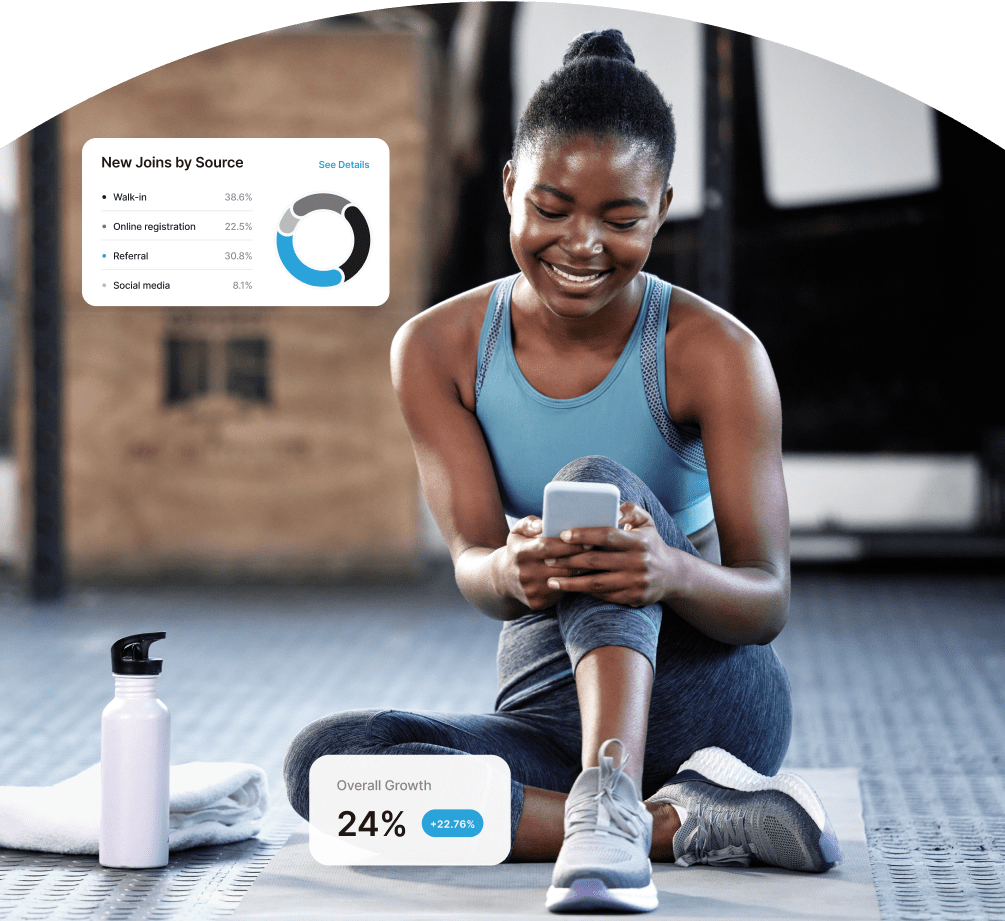

We’re on a mission to empower individuals to become the best version of themselves by making fitness accessible with innovative technology. Our holistic fitness software makes it simple for customers to stay active and engaged by supporting fitness businesses worldwide. ABC Fitness’ solutions streamline business operations and provide in-depth insights to unlock opportunities for evolution and long-term growth.

Innovative Solutions for Every Business Size

Our best-of-breed fitness software platforms serve all areas of the fitness industry from boutique studios,

to international franchises and personal trainers.

US or Canadian Gym, Health Club,

or Fitness Center

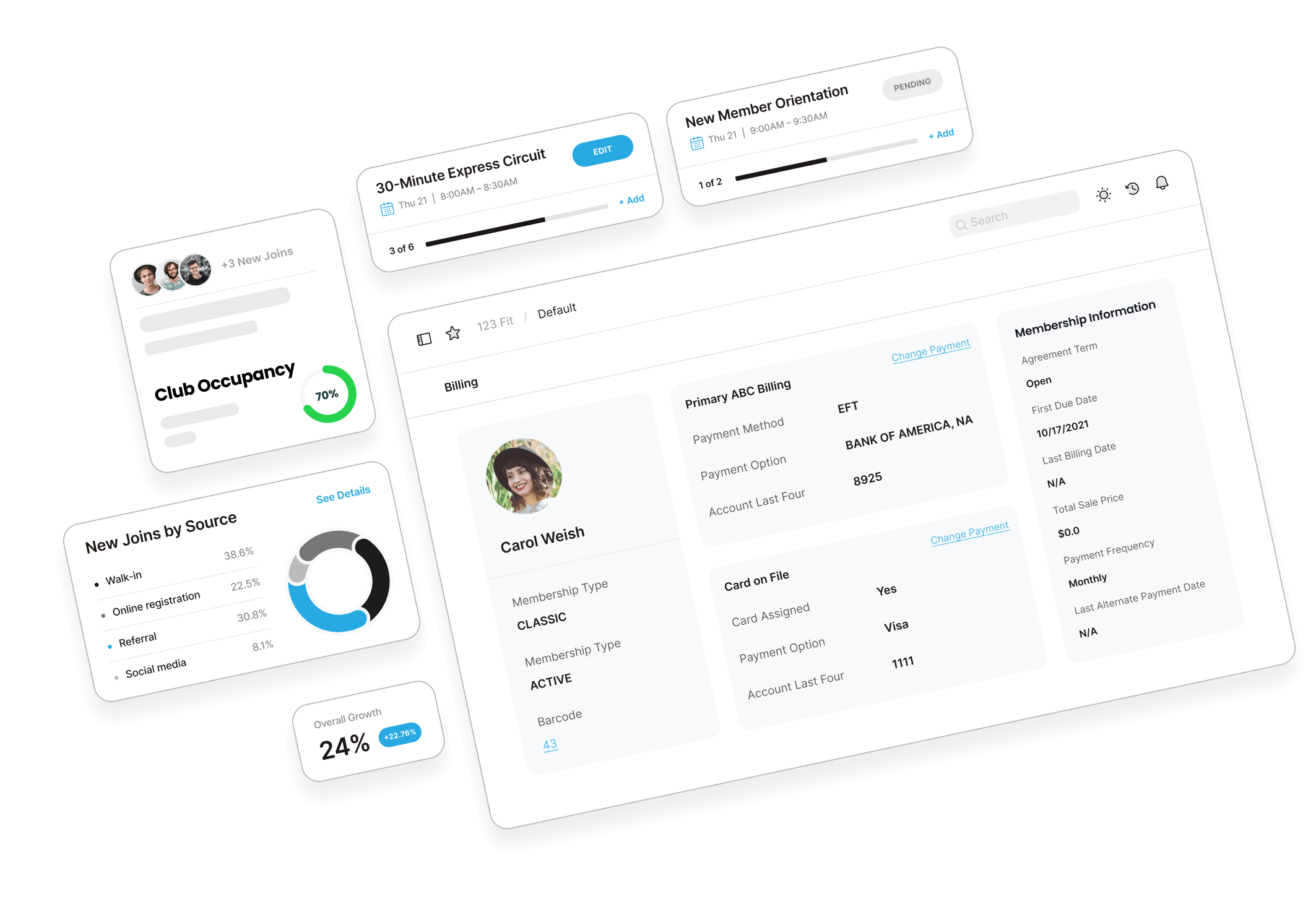

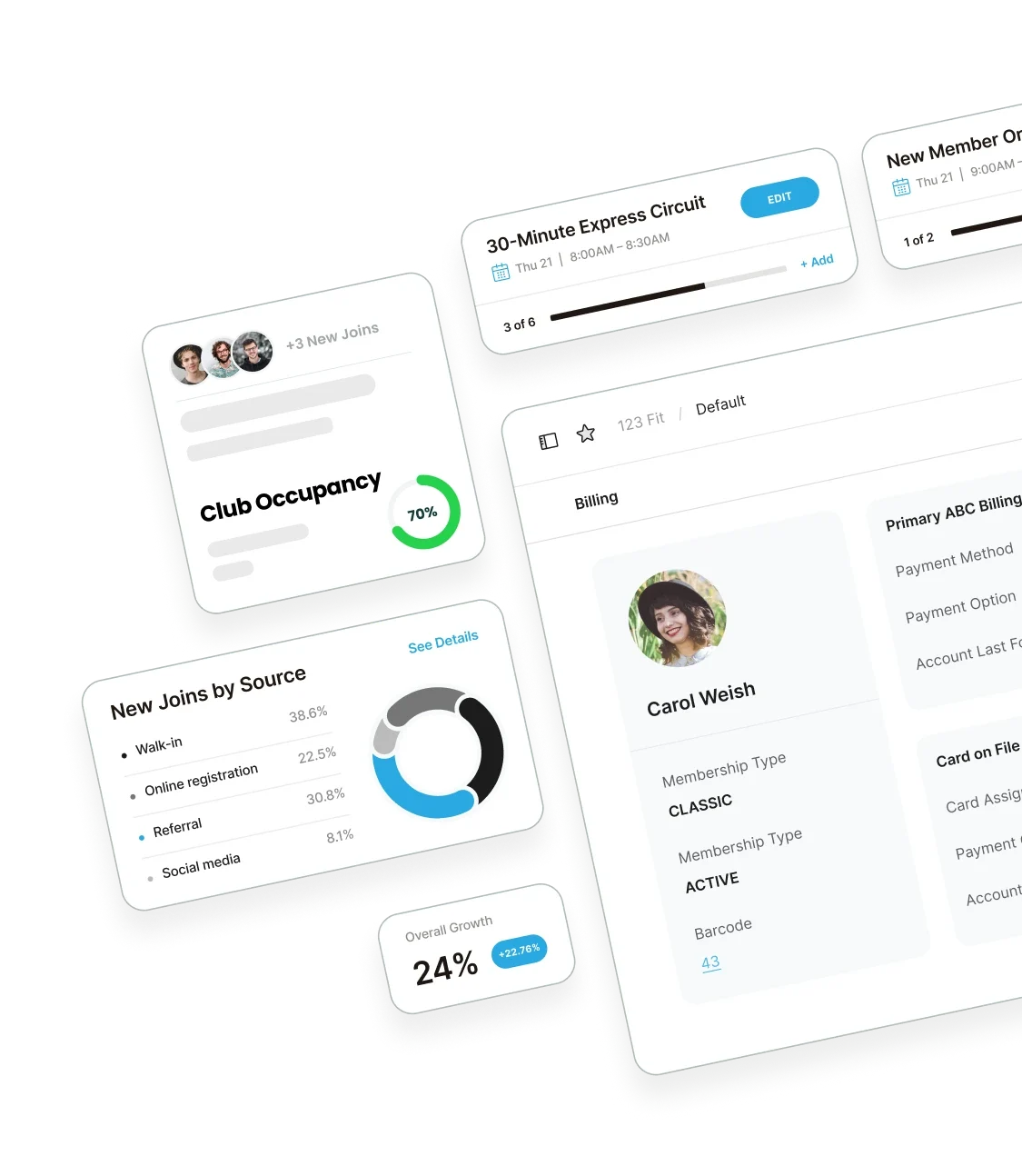

ABC Ignite is fully integrated gym management software trusted by more than 30,000 clubs across North America. Ignite streamlines operations, maximizes member retention and scales fitness businesses for future growth. You might know this platform by the name of its predecessor, Datatrak or ABC Financial.

Latin American Gym, Health Club,

or Fitness Center

ABC Evo is gym management software dedicated to the Latin American market. Evo provides fitness clubs with an intuitive platform that empowers their businesses to elevate operations and customer experience.

Boutique Fitness or Studio

ABC Glofox is all-in-one platform designed with boutique studios in mind. Glofox optimizes all aspects of the business with a powerful suite of tools for fitness studios of all types and sizes.

Personal Trainer or Coach

ABC Trainerize takes your coaching or fitness business online to deliver an exceptional experience for clients. The Trainerize app expands your reach beyond the gym with fitness, nutrition and habit-coaching features along with in-app messaging and progress tracking.

40+ Years Providing Fitness Software and Solutions

Check out our quick hits to see how we’re making an impact for fitness businesses worldwide.

-

40M

Members Worldwide

-

40%

of US Fitness Businesses Trust ABC to Help Them

-

570K

Coaches and Trainers

-

24M

Habits completed

-

530M

Workouts Tracked

-

Years of

Experience40

-

$11B

Annual Payment Processing

-

174M

Meals Logged

-

30K

Gyms & Clubs in 100+ Countries